The Indian Slowdown

While the long-term fundamentals remain attractive, the high valuation of the Indian market and a rather notable slowdown in economic activities will impact stock market performance.

The bull case for India is there are multiple drivers for underlying economic growth. The country had gone through 10 years of economic reform under the current government. It took the banking system just as long to recover from the last capital expenditure boom bust cycle. In addition, it is seen as the rising power, which can adroitly navigate the geopolitical tug-of-war, and is seen as of strategic importance to both camps.

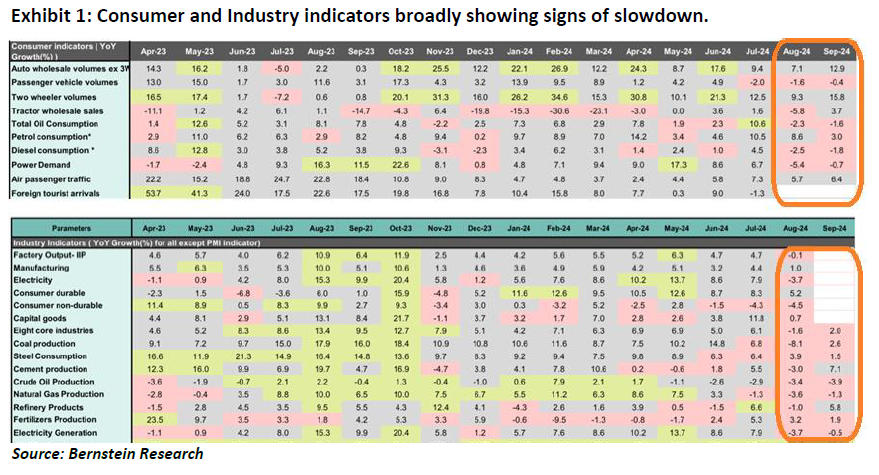

In recent months, there are clear signs that the economy is suddenly slowing down after several years of strength post-COVID. We are seeing weak of loan growth amongst banks, a worsening credit cycle in the credit card and micro-finance sectors. The sudden slowdown in economic activity caught many companies unaware. Almost 50% of companies in the market missed their quarterly earnings recently. On average, they were expected to grow earnings 9% from a year prior, but many companies reported barely flat earnings. Furthermore, many sectors were caught up, including autos, consumer stables, power generators.

Truth is Indian consumers have now exhausted their excess savings accumulated during COVID. Similar to other economies, urban consumers in India are squeezed by higher cost of living, such as rental and slowing wage growth. This round of consumption slow down coincides with tighter spending discipline by the government, as well as higher interest rate. As inflation is currently running “hot”, chances of a rate cuts have diminished.

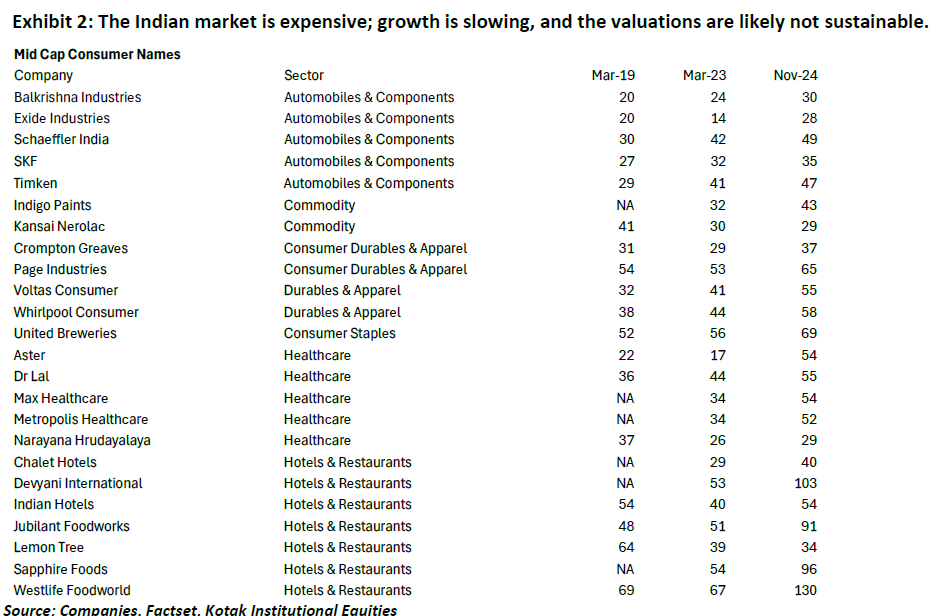

Despite macro-economic uncertainty, valuation of the market remains expensive. Below is mid-cap price-to-earnings multiples in different periods. With growth slowing down, the sky-high valuation will likely not be sustainable.

Last, but not least, the volume of IPOs and equity raising in India is surging. A plethora of IPOs marked the top of markets historically.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.