The China Pivot: Progress so far

We believe that the China policy pivot to stimulate the economy is highly significant. The government is looking to fight deflation and reflate the economy.

The property market is a key pillar to the economy, as it underpins confidence, consumption and investment. The weakening property market has been a key contributing factor behind the deflationary impulse. The good news is that the property sector has already adjusted, with sales for new apartments having come down around 60% from peak and new property starts have declined to multi decade-low level.

Property stimulus involves the government buying old properties for urban re-development from existing property owners, who can then buy new properties and reduce unsold inventories. The target is to acquire around 1M apartments in the top 35 cities, which will add up to 1/3 of current unsold inventory by our estimates. Similar measures were undertaken during the last property cycle and was successful.

There are measures to ensure developers can complete their projects that are under construction. The sum involved is RMB4 trillion and it comes in the form of whitelist lending program for property projects. Property sales will accelerate as buyers gain confidence that off-the-plan developments will be completed.

Lack lustre land sales have hurt local government finances. Improving property market will bolster local government finance. Further, the Central government will likely initiate debt swaps with the local governments. This will allow local Governments to spend more locally to restore confidence and spur construction and consumption activities.

With respect to the stock market, the PBOC is offering low-cost finance for financial institutions and corporates to buy shares. The first set of facility is RMB800 billion worth.

The pivot is significant as it represents a recognition from the top that the weakening property market is pressuring the economy, and this lack of confidence cannot be addressed by market forces alone. These initiatives will serve to inject liquidity back into the real economy, the public sector, as well as the stock market. The goal is clear. Beijing is looking to fight deflation and reflate the economy.

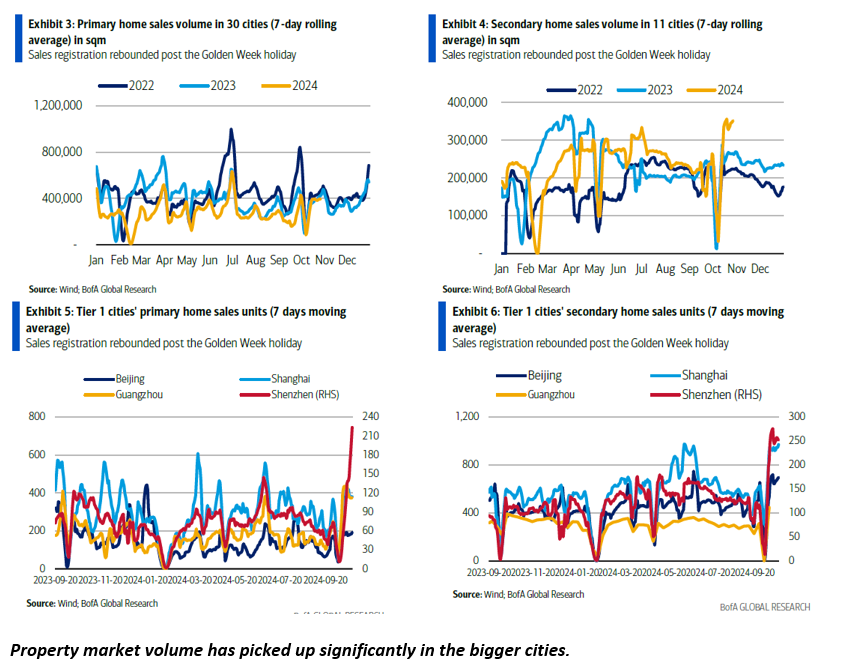

Since the announcement of the pivot, property transaction volumes and prices (at least in the bigger cities) have picked up, and stock prices have bottomed and started appreciating. Considering much downward adjustment has already taken place in both the property and stock market, a strong rebound is likely as these comprehensive policies are implemented. Fuelled by low interest rates, asset price momentum will sustain.

The reality is, given the relative un-indebtedness of the Central Government in China, even a reasonably sensible fiscal push (USD 1 trillion) will translate into significant improvement in end demand. In our view, China is in a better financial position compared to that of the US, in which the Federal Government is running a USD2 trillion deficit despite a booming domestic economy, on top of an elevated level of indebtedness.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.