The Case for Emerging Markets: Part 2

EM Economies May Be More Resilient Than Thought

The fact that EM is attractively valued relative to history suggests that investor enthusiasm towards EM has waned. Investors may hesitate because EM economies have an image problem. They are often perceived to be fragile, highly indebted, or that they will be perpetually stuck in what economists termed “the middle-income trap”, hitting a growth ceiling.

The reality is a lot rosier than perception. Instead, we would submit that it is time to be bold. Some of the fastest growing and well managed companies are selling on amazingly attractive valuations!

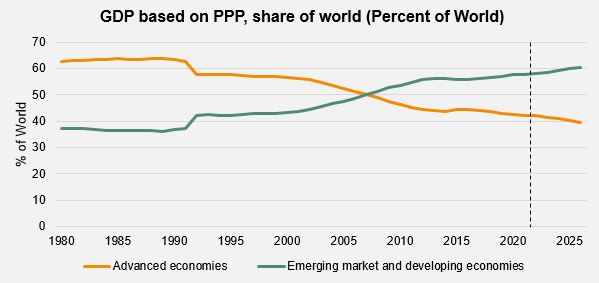

EM is a big part of the world these days, responsible for 60% of global output in 2020 vs 40% only two decades ago. EM accounts for greater than 65% of annual economic growth in the world. These trends look far from exhausted.

Source: International Monetary Fund http://imf.org

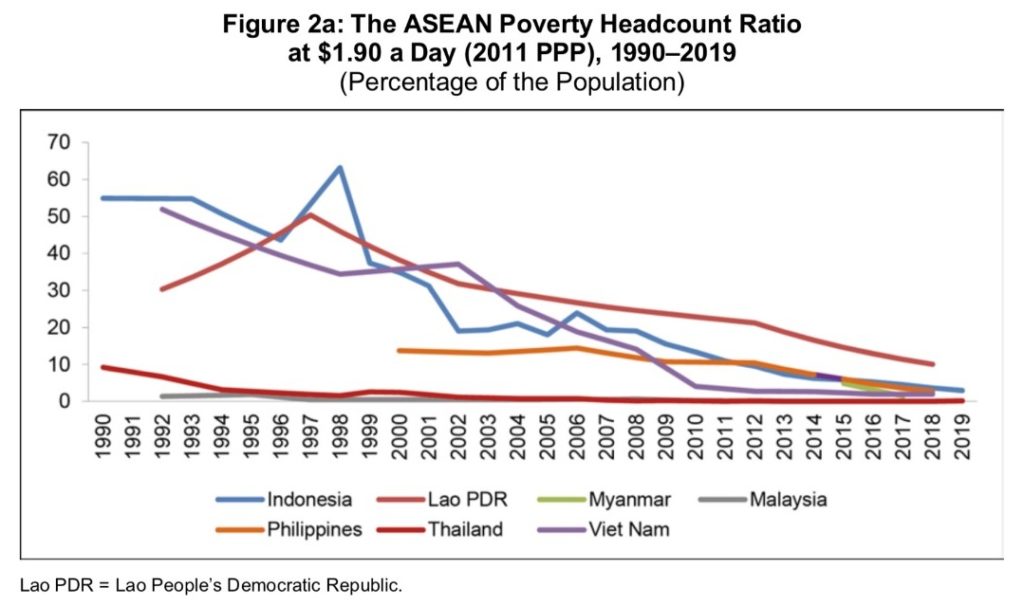

What this means in practical terms for the billions of people living in EM countries is a dramatic reduction in poverty. It means they have much better access to food, healthcare, housing and they are also increasingly focused on how to make the world a better place, for example improving the environment.

Source: UN data. Accessed 7 April 2021. http://data.un.org/

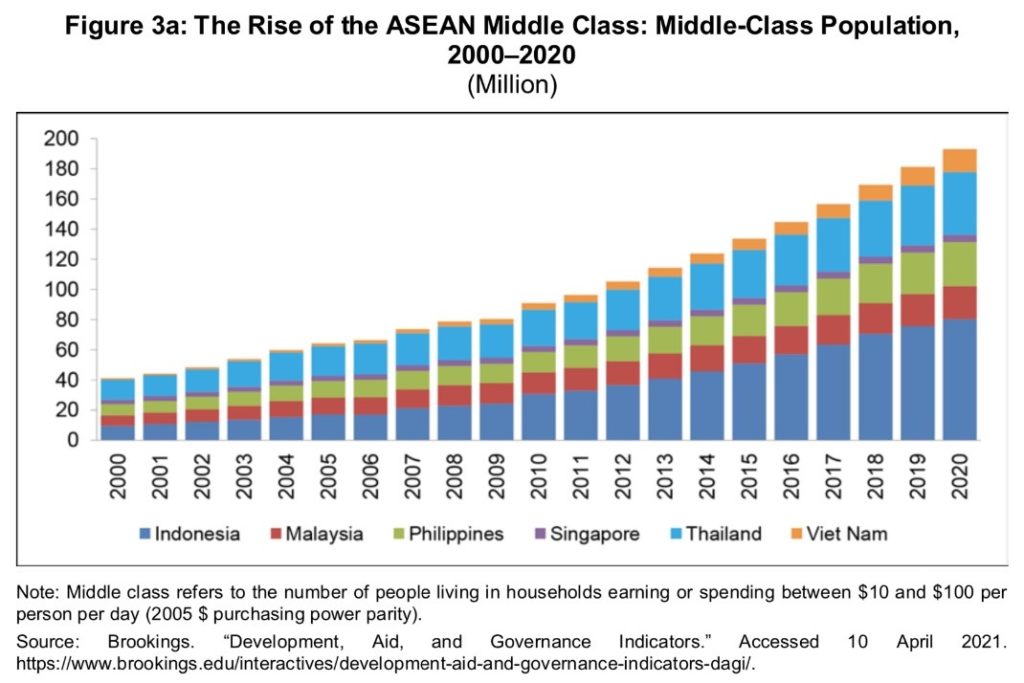

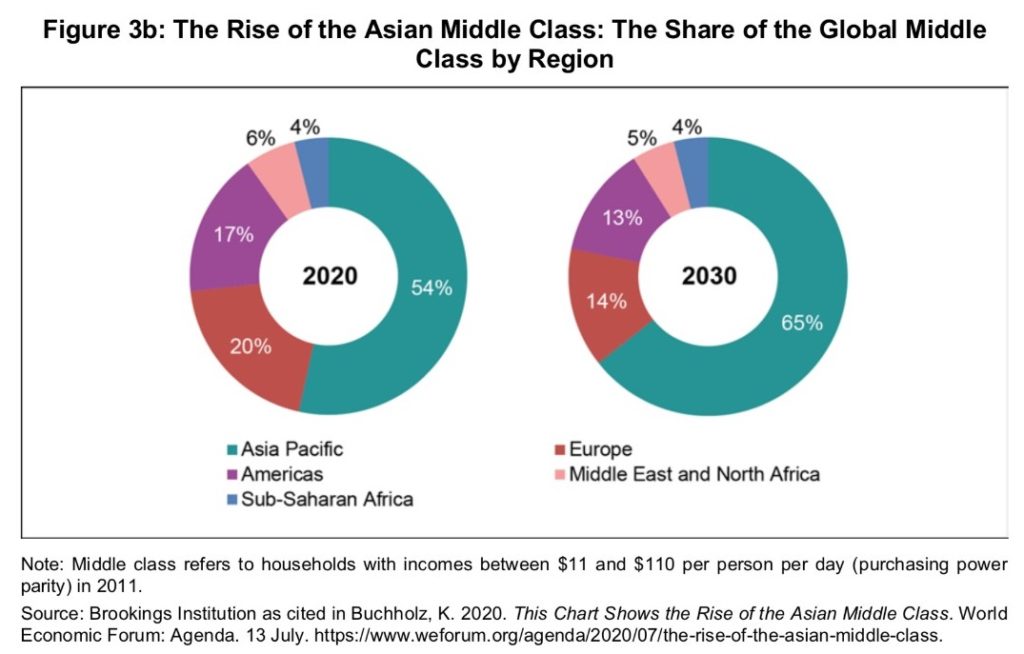

The other side of the coin of poverty reduction is the rising purchasing power for the masses. Based on Asian Development Bank estimates, the number of middle-class people in EM is ballooning. In fact, the rising middle class in EM now forms the largest and fastest growing pool of consumers in the world. In due course, these EM countries will become less reliant on trade and independent of external factors. Growth in EM will be increasingly driven by endogenous forces.

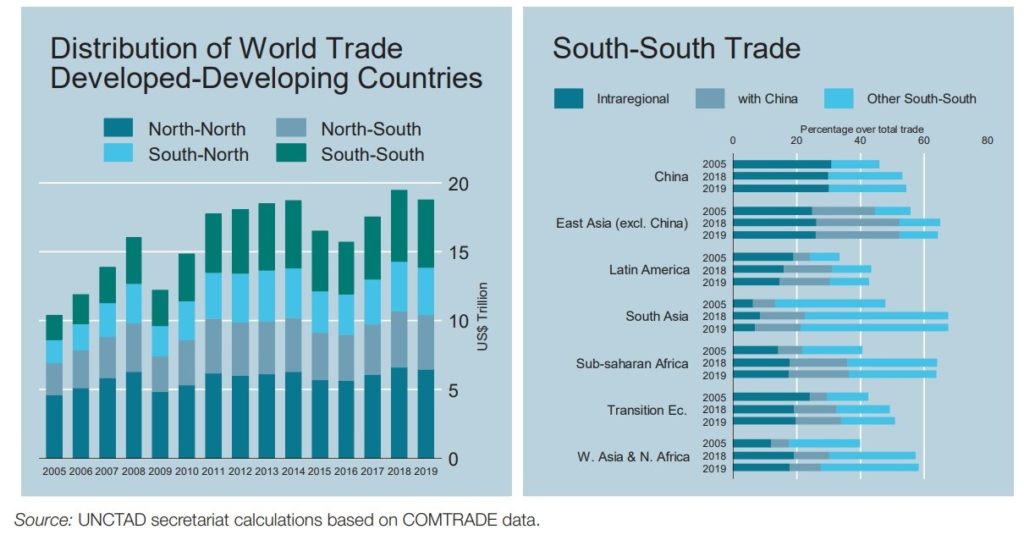

Intra-regional trade is another factor supporting greater economic resiliency. EM is no longer small economies that are linked tightly to the demand fluctuations of the advanced economies. Not only has trade volume been expanding overall for EM countries, the proportion they trade with each other has been going up. This is one of the reasons why the impact of the US-China trade war has had been relatively muted. The fact is the US consumers are not the biggest buyers of Chinese exports anymore.

Our readers may remember the Asia Financial Crisis and believe that Asian economies are still poorly managed. This perception is no longer fair.

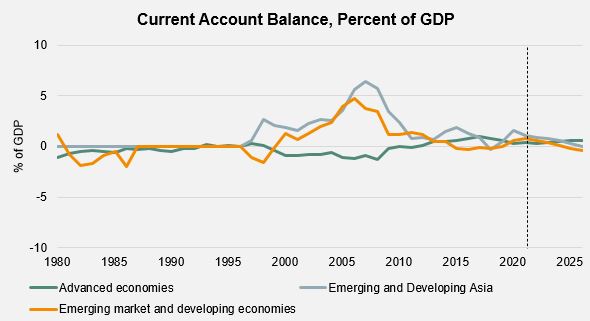

The Asian Financial Crisis took place in the late 1990’s, after a decade of bustling economic growth driven by investment that is funded by foreign borrowing. Many Asian countries were running big trade deficits (or current account deficits). In other words, Asia imported more than it exported. These countries were not earning sufficient foreign currencies to pay back the ever-increasing foreign debt. It was a house of cards which predictably ended in tears.

The pain of the Asia crisis cut deep. Even today, investors and officials remember the deep scars from more than 20 years ago. They remain prudent in their borrowing and business dealings, very different to the profligate spending years gone by. The current account position of emerging economies has since improved out of sight post crisis, and their debt levels remain very conservative to date.

Source: IMF, 2021

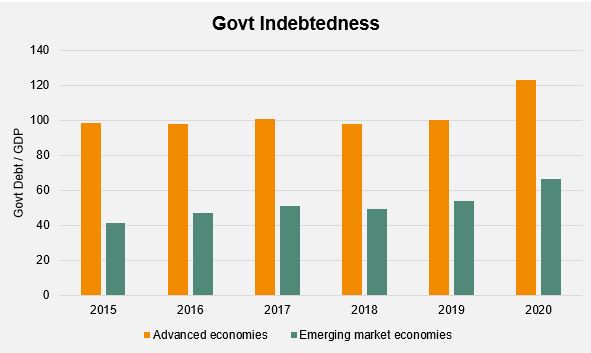

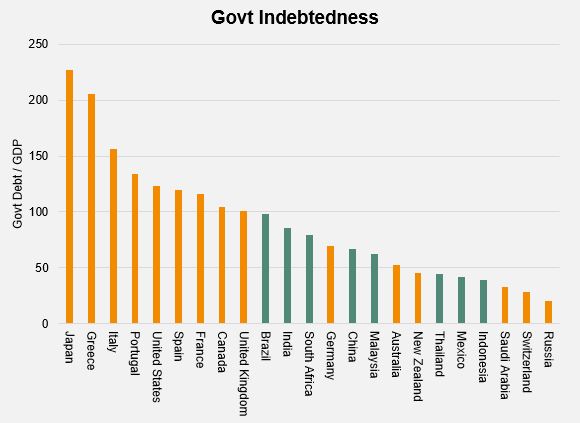

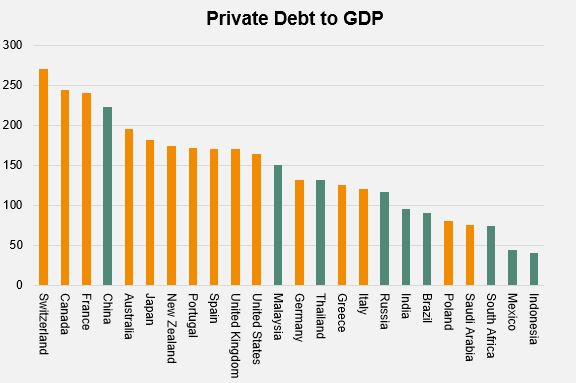

The level of government debt has stayed low for Asia. Government debt to GDP measures government indebtedness relative to the size of the economy. EM economies government debt level is roughly half of that of advanced economies. In fact, most EM countries have similar or lower level of government debt compared to the paragon of fiscally conservatism – Germany. EM private debt is also low.

China has a relatively high private debt ratio. A big proportion of the debt was issued to state companies, and no doubt some of the loans would not have passed stringent commercial risk requirements. A lot of money has gone into heavy industries (steel mills, cement plants, chemical plants etc.) and infrastructure (roads, bridges, tunnels, rail, etc.). The money has not been completely wasted. While these projects were not the most lucrative commercial investments available, they do contribute to the long-term competitiveness of China Inc. Toll roads can get congested rather quickly for a fast-growing economy.

The debt problem is manageable even if a proportion of lending was “policy lending” so to speak. These loans are denominated in local currencies (the RMB). The government has ample resources to deal with the bad debt with the help of its own central bank who, like that of many other countries, have their money printing machine armed and loaded if necessary.

Source: BIS https://stats.bis.org/statx/srs/table/f5.4?p=20204&c=

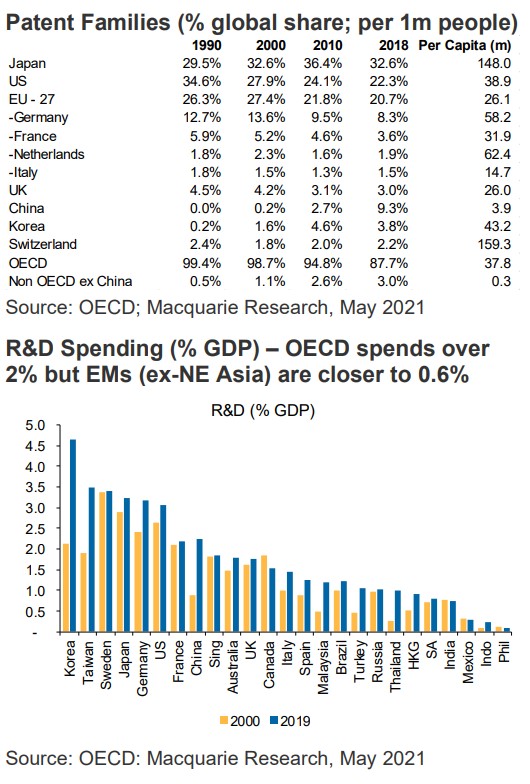

The basis for a long term self-sustainable income growth trajectory in some countries is technology and education. Given the right level of investment in technology and education, countries have a good chance of reaching advanced countries income levels.

Japan and Korea have shown the way in demonstrating the importance of investing in technology and education. They have a decent share of the triadic patent families (which usually means patents are serious and valuable). China is starting to ramp up rather quickly, paving the way for indigenous technological innovation.

As investors, we do not want to miss this amazing opportunity especially when the market is not paying enough attention and great companies are attractively valued. There are different ways to benefit. We prefer to focus on sectors that will see long term tailwinds: Consumers, Financials, Internet, Healthcare and Technologies. We look for companies with strong management who share our values, for example a focus on ESG. Although the prize is big, EM investing is not straightforward. We believe we have the necessary experience and discipline to succeed.

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.