The Case for Emerging Markets: Part 1

Emerging countries have been growing at a relatively fast pace over the last decade, but the performance of the emerging markets has been lacklustre. This paper examines what is driving the persistent growth in emerging countries and why now may be a once in a lifetime opportunity to capture this investment opportunity.

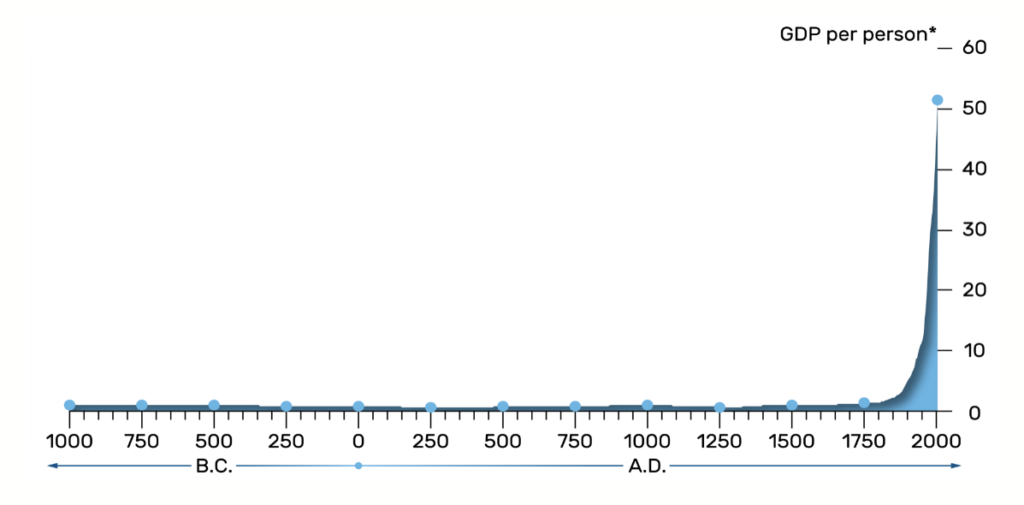

It may surprise many that rapid economic growth is a relatively new concept in the history of the world. According to the Bank of England, income per person (as measured by GDP per person) did not change much for 3,000 years prior to 1750. Suddenly, someone flicked on the boost button and incomes took off!

Source: Data from DeLong (1998)

In fact, income per person, hitherto had been edging up at a rather leisurely pace of 0.01% a year, accelerated to approximately 1.5% a year! What this meant was, before 1750, it would have taken 6,000 years for the global economy to double in size. It only took 50 years after 1750 to double again! The impact on living standards was obviously incredible.

The few critical enabling factors for rapid economic development appear to relate to improvements in institutions, investment in infrastructure, adoption of free markets and industrialization of manufacturing.

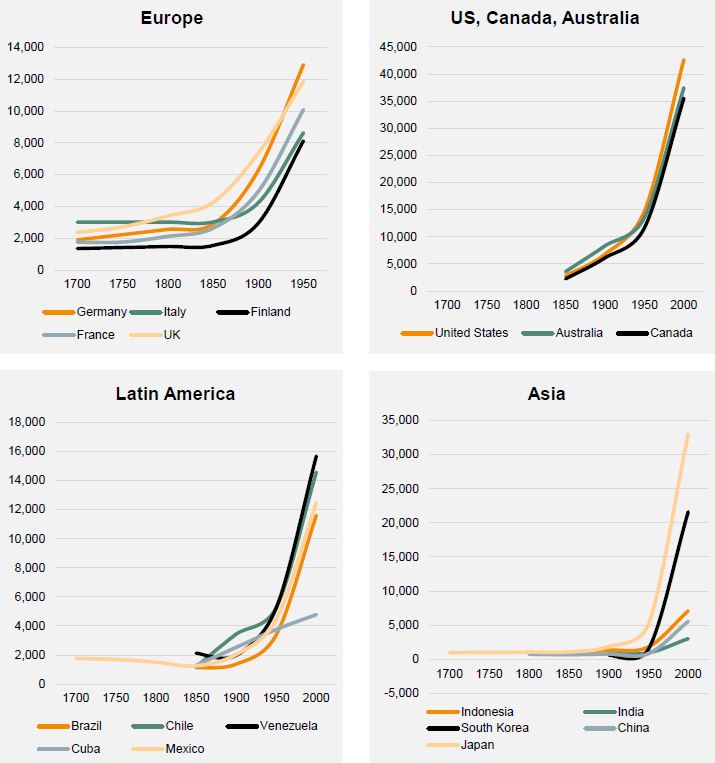

The growth wave started in Europe, as one country followed another into accelerated growth. As these new ideas permeated throughout the world, other continents followed suit.

USA, Canada and Australia followed quickly. The growth wave started after 1850s in the Latin America (Lat Am) region. The next train to leave the platform was the Asian region, led by Japan, the Asian Tigers (South Korea, Hong Kong, Singapore and Taiwan) and then the Tiger Cubs (South East Asian countries), as shown in the charts below.

Income per person in 2011 dollars (purchasing power parity)

Source: Maddison Project Database 2018, Ox Capital

This process is powerful. With the right ingredients, a rise in GDP or income level is inexorable.

Importantly, growth plateaued for some countries once they reached a certain income level. This could be due to many internal and external factors. Cuba, and some Latin American countries seem to have hit a speed bump.

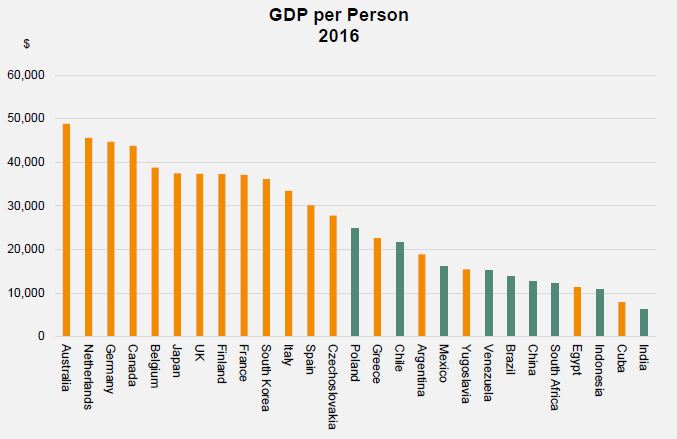

Source: Maddison Project Database 2018

The first observation to note is that most countries can get to $15,000 per person, with the better managed economies getting to $30,000 to $50,000. The populous economies of the emerging markets, like India, China, Indonesia and Brazil are just getting started and could further lose the income gap in the coming years.

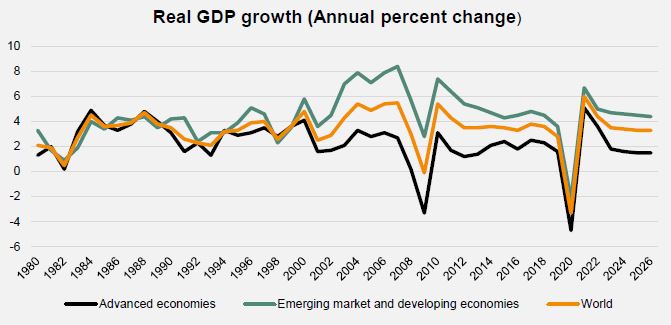

Emerging economies have indeed been catching up. Developing countries have been growing 5%-6% annually, and the advanced economies growing at 1.5-2.5% for decades. As emerging countries have gotten to a percentage share of the global economy, with a faster growth rate, they are propelling global economic growth.

Source: IMF

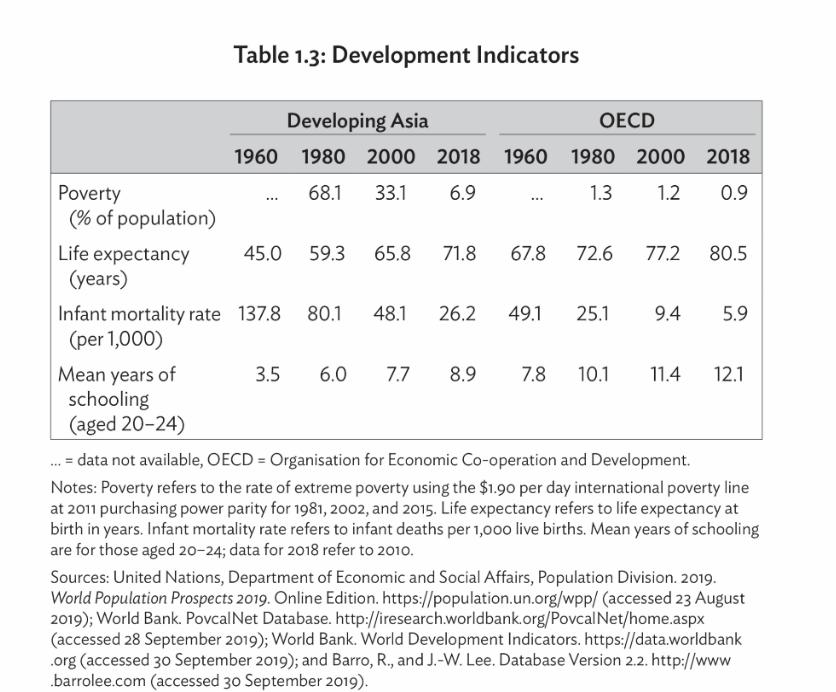

The benefits of sustained economic development are a fantastic bonanza for the population. Being able to afford better living standards means better hygiene practices, better healthcare, and better and more equal access to education. The wealthier they are, the more they are able to look after the environment.

The positive impact on women and girls is stark. In 1960, women received fewer years of schooling. By 2010, they completed more years in school than men in the majority of Asian countries. Women’s life expectancy also improved significantly, and there has also been a consistent decline in maternal mortality. On the employment front, female labor force participation increased substantially over the past 50 years in Asia, although gender gaps persist.

Despite faster economic growth and rising living standards, an obvious question for an investor is whether investing in EM is worthwhile considering the inherently less mature regulatory environment and the associated risks. Would it systematically lead to persistently poor investment returns?

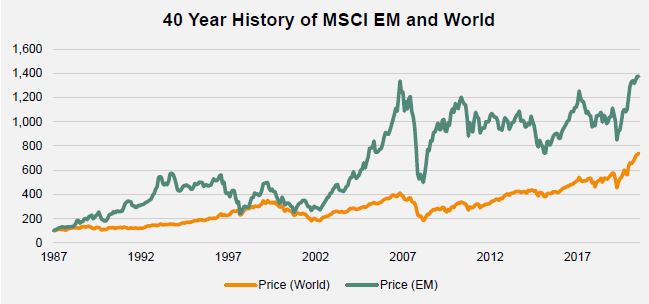

The answer surprisingly is that over the long term, EM investing has been highly lucrative for investors. Over the last 40 years or so, emerging markets have significantly outperformed developed markets. Given the underperformance of emerging markets over the recent decade, this may surprise some.

Source: Bloomberg

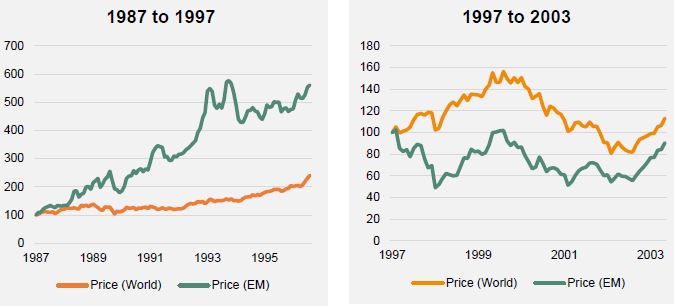

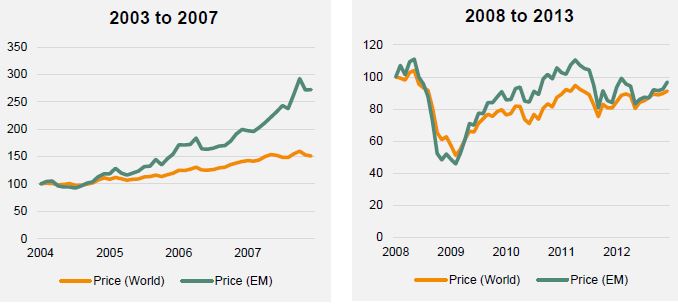

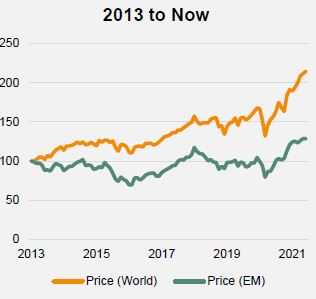

In fact, emerging markets have tended to match that of developed markets in most periods. The last decade of underperformance was unusual. It was the result of a high starting valuation post the 2007 emerging market bubble.

Source: Bloomberg

As these fast-growing economies leap ahead in sophistication, new businesses have spring up dominating their respective fields, and many have emerged as global leaders. As a result, the make-up of the EM equity universe has also been transformed. Instead of being dominated by low quality resources companies, the EM markets are filled with superstars in information technology (internet behemoths), leading consumer brands, dominant retailers and resilient financial institutions. Asia’s economic growth has been the standout in the last couple of decades. For investors, there are numerous quality businesses to pick from.

| MSCI EM | 2007 | 2021 | MSCI World | 2007 | 2021 | |

| Info Tech | 13.2% | 20.6% | Info Tech | 10.1% | 23.1% | |

| Financials | 22.8% | 19.8% | Financials | 26.5% | 13.4% | |

| Consumer Discretionary | 5.1% | 16.8% | Health | 9.0% | 13.2% | |

| Telecom | 9.7% | 11.1% | Consumer Discretionary | 10.7% | 12.4% | |

| Materials | 14.3% | 8.6% | Industrials | 10.2% | 10.8% | |

| Consumer Staples | 4.8% | 5.7% | Telecom | 4.7% | 9.4% | |

| Health | 1.6% | 5.1% | Consumer Staples | 8.4% | 7.3% | |

| Industrials | 8.4% | 5.0% | Materials | 6.2% | 4.5% | |

| Energy | 16.7% | 4.9% | Energy | 9.5% | 3.0% | |

| Utilities | 3.3% | 2.0% | Utilities | 4.6% | 2.9% |

Source: MSCI

Note rise in weighting of quality info tech and consumers and fall in resources for EM.

| MSCI EM | 2007 | 2021 |

| Asia | 54.6% | 84.2% |

| LatAm | 20.4% | 6.9% |

| Others | 25.0% | 9.0% |

Source: MSCI

Asia has taken the lead in economic development and this is reflected in its growing weight in equity indices.

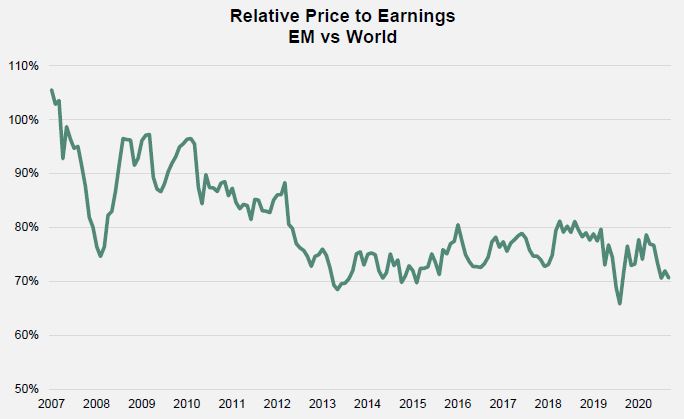

After a decade of underperformance, the valuation of EM stocks has adjusted down significantly, and valuation relative to developed markets is at a multiyear low. Given the improvement in quality of the companies in the index over the years, we believe stocks in EM are attractively valued.

Source: Bloomberg

Not only does EM offer fast inexorable sustainable growth at a discount – making now a not-to-miss opportunity to invest – the economic resilience of EM has also improved out of sight. We will discuss this in our next instalment, The Case for Emerging Markets: Part 2.