A 21-hour day: The life of an EM fund manager

Investing in emerging markets can be fraught with extra risks. Money Management spoke with Ox Capital, along with other EM specialists, about how they navigate this challenge in their day-to-day fund management

The MOAT: A Quantitative Tool to Track the Flow of Money

In this short video, we explain our proprietary quantitative model called the Macro Overlay Aggregate Tracker, otherwise known as ‘the MOAT’.

Driving the way forward

China’s dynamic economy sees its automotive sector thriving as the world’s largest manufacturer and exporter, defying negative sentiment with strong domestic and competitive overseas performance.

China Property: Reality vs. Noise

We expect the Chinese property market slowdown to have a limited economic impact. The moderate decline in property prices indicates a smaller-than-perceived property bubble.

The OxCap MOAT

At Ox Capital, our investment framework is rooted in identifying quality businesses with long-term sustainable growth thematics to drive outperformance. In this piece, we explore our proprietary quantitative model called the Macro Overlay Aggregate Tracker (MOAT.)

Revisiting the GFC playbook

Why buying China equities now is like buying US equities during the GFC. Chinese equities are trading at mouth-watering attractive levels. In our view, the outlook is highly prospective for long term investors.

Ox Capital’s 2024 Outlook: Video Update

In our 2024 outlook video, Joseph Lai discusses the historical impact of the Year of the Dragon on Asian equities, recent high-level dialogues between the US and China, the multi-year transition of China’s economy, and more.

Looking through the headline noise

We are seeing a clear dislocation between reality and stock market sentiment. Contrary to news headlines of a lacklustre macro-economic environment and outlook, quality companies continue to execute and grow earnings, highlighting the importance of looking through the noise.

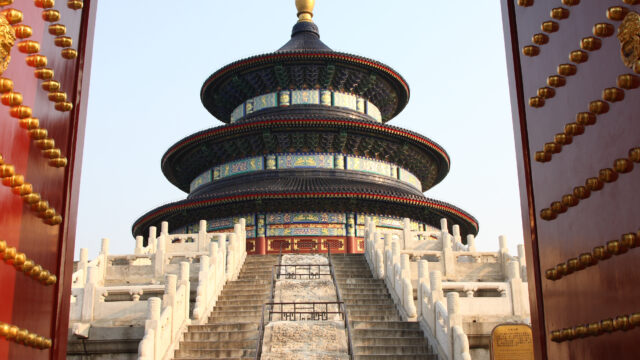

2024 Outlook: An Inflection Point for Emerging Markets

Welcome to 2024, the Year of the Dragon in the Chinese Zodiac. In this report, we outline our key expectations and themes across emerging markets in 2024 and how we are positioned.

Why Bother Investing in China?

Ox Capital follows an investment philosophy of acquiring future champion businesses at discounted valuations. Despite facing economic challenges, the Chinese economy is expected to overcome negative factors, such as reduced reliance on the property sector, geopolitical pressure, and ongoing economic reforms. Right now, we see an opportunity to invest and take advantage of these very attractive valuations.