Looking through the headline noise

Reality vs. sentiment

We are seeing a clear dislocation between reality and stock market sentiment. Contrary to news headlines of a lacklustre macro-economic environment and outlook, quality companies continue to execute and grow earnings. The overall economy is resilient and showing pockets of strength. Headwinds to the property market are manageable and well understood. Our base case is the Chinese economy will grow this year (4.5% to low 5% range) and we continue to expect the Chinese authorities to provide support for the economy to restore confidence. After sharp pullbacks in Chinese equities, the authorities are intervening, introducing various measures to support the stock market. It’s important to look through the noise.

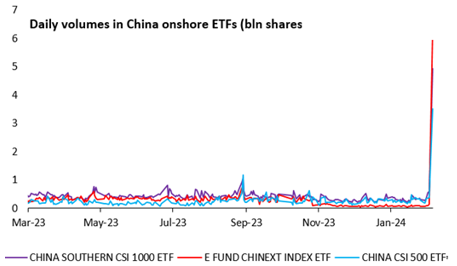

Return of the flow. Daily volumes of on shore ETFs have spiked. This is important, as the National Team (China’s Sovereign Fund) has proactively intervened with direct purchase of equities/ETFs to support the market. The Sovereign fund also vows to further increase ETF holdings to support the market as needed. This reminds us of when the Hong Kong government stepped in during the Asian Crisis to support the market and uphold stability.

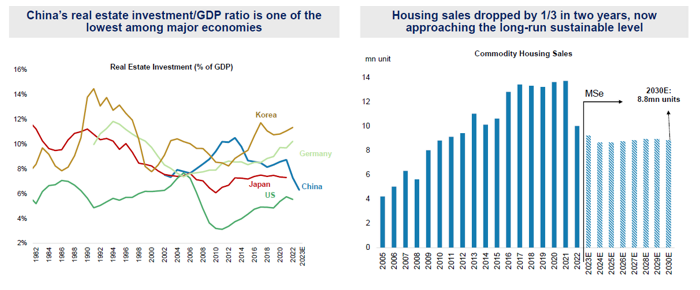

Recurring headlines are somewhat old news. Despite recent headlines, the Chinese property downturn is in fact quite advanced. This is a well-known fact as sales are down over 40% since peak. Developer loans exposure to the baking system is low (less than 6%). Distressed developers have defaulted, while contagion to the trust industry is low and very manageable. The news of property developer Evergrande’s inevitable collapse was well known despite recent articles highlighting its demise. Again, it’s important to look through the noise. The government extending support for local developers (both private and state owned) through banks with measures to improve developers’ liquidity will further improve confidence. Moreover, China’s real estate investment relative to GDP remains one of the lowest relative to other major economies while sales are approaching sustainable levels after years of declines.

Finally, the government continues to show willingness to provide support by easing policy further. The PSL (China’s version of QE) grew in December and January to fund urban village redevelopment and social housing. In addition, the PBoC recently lowered the deposit reserve ratio requirements of financial institutions by 0.5%, in-line with prior guidance of further monetary policy easing. As such, the reduction in reserve requirements will provide liquidity, benefiting the real estate market and economy overall, supporting consumer confidence even further. We do acknowledge however, the stimulus measures all up (including urban redevelopment, lower mortgage rates, ect..) will take time to fully restore confidence and strengthen the economic outlook.

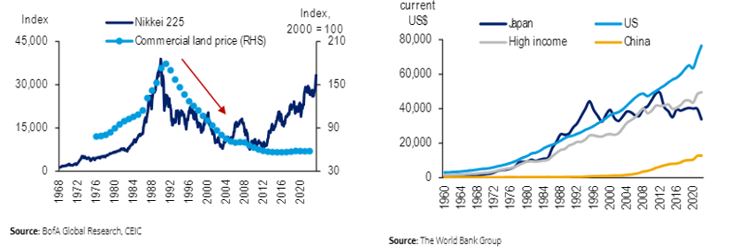

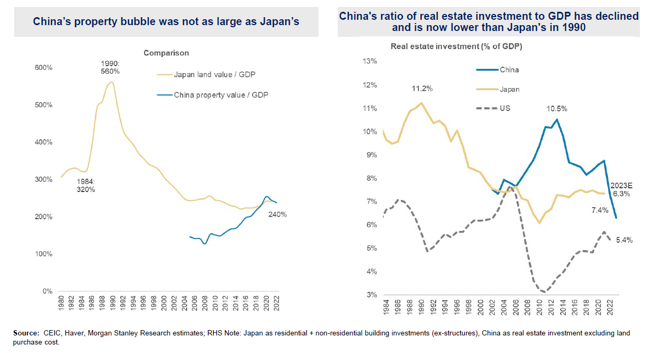

China is not Japan’s “Lost Decade”: There have been a recent uptick in headlines and concerns that China’s outlook is similar to Japan in the 1990s when there was a period of economic stagnation and a significant slow-down in economic activity and the asset bubble eventually collapsed. Notable differences:

- China’s GDP per capita (12K) is much lower than that of Japan in the 1990s

- China’s property bubble is not as large as Japan’s during that period

- The ratio of real estate to GDP has declined and much lower than Japan was in the 90s

- Limited gains in stock prices over the past decade for Chinese indices

Right now, valuations for Chinese equities are at depressed levels, and at a time when government authorities are dedicated to restoring confidence and reinvigorating the economy. Quality businesses will continue to grow and become champion businesses in coming years. Now is the time to invest and take advantage of the very attractive valuations. As we have stated previously, it is important to consider the multiple catalysts and act now given 1) valuations are extremely cheap, 2) property market is stabilising, 3) China QE “PSL” is supporting the economy (and restoring confidence) at this juncture, 4) Chinese capital replacing international flows in Hong Kong equities market, 5) National Team providing stability, and 6) geopolitical stabilisation.

In our view, the champion Chinese companies in the OxCap portfolio have the set-up for “hockey stick” growth.

At Ox Capital, we are focussed on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.