Indonesia: An Economic Powerhouse

Robust growth underpinned by domestic consumption and solid FDI!

The Indonesian economy is undergoing a dramatic economic transformation that is underpinned by a young and growing population, abundant natural resources, and its strategic location in the South Asia region. During our recent visit to Indonesia, we found the equity market to be outside of the spotlight of many foreign investors despite companies having strong endogenous growth drivers, supporting economic outlook over the coming years.

We believe the environment & outlook is supportive of equity market performance, which are currently on cheap valuations relative to history.

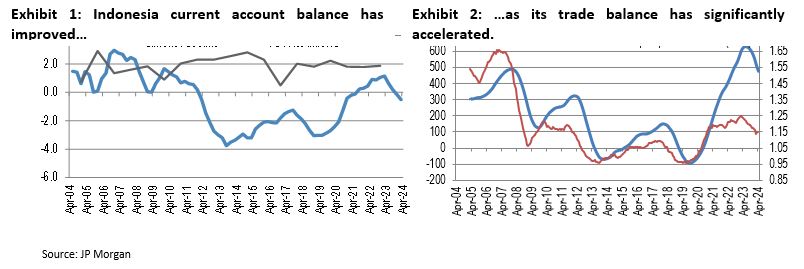

- A robust economy. Real GDP is expected to grow at ~5% through 2025 per the IMF. The government is fiscally responsible (deficit of less than 2.3% of GDP). Its trade position is strong thanks to resilient commodity demand and improving manufacturing capabilities.

- Rate cuts and USD weakness. With growing anticipation of further US interest rate cuts, the Indonesia Rupiah (IDR), amongst other Asian currencies, has already seen significant appreciation against the dollar. Notably, attractive equity valuations and appreciating currencies are strong tailwinds for Indonesian equities which should drive additional funds flow into the economy.

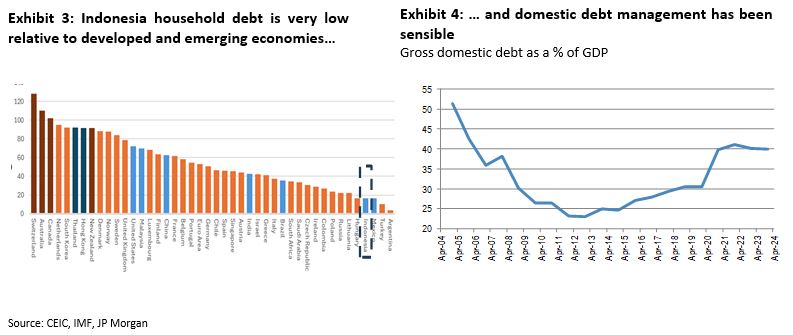

- Low indebtedness. Indonesia households are less indebted compared to that of other advanced economies and emerging markets, at just ~10% of GDP. For example, Australia household debt is much higher at ~116% of GDP. Indonesia’s central bank recently cut its official interest rate by 25bps to 6%, the first in the region to cut ahead of the first US FED rate cut, and should spur credit demand. Its low levels of debt to GDP leaves ample room for the various sectors to increase borrowings, driving economic activities.

- Demographic Dividends. Indonesia is world’s fourth-most populous country, with ~280mn people, representing a huge domestic market. More importantly, the median age is around 30 years old, a demographic advantage that supports both consumption and labour supply both of which sustain economic expansion longer term.

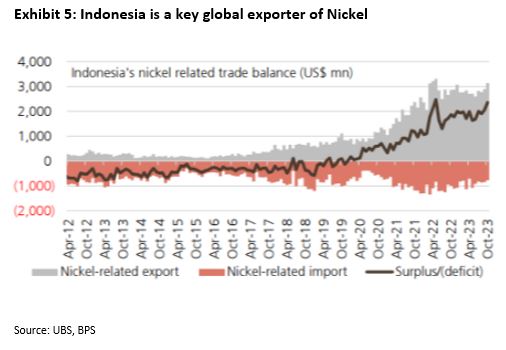

- Abundant natural resources. Indonesia is rich in natural resources & commodities, such as oil, gas, coal, palm oil, and minerals like nickel. These resources provide a steady stream of export revenue and attract foreign investment. Demand for these resources have boosted its exports. In fact, Indonesia has one of the world’s biggest endowments of Nickel, producing over half of global supply. We expect this will benefit Indonesia’s terms of trade, and fuel investment growth for years to come.

There has already been infrastructure spending in this domain including large plant installations to convert the countries surface layer Nickel to be processed into battery grade nickel. Electric vehicles and batteries makers are set to invest in Indonesia to bolster their nickel supply chain.

- Strategic location for trade & nearshoring. Foreign direct investment (FDI) continues to stream in, seeking to provide more quality goods to increasingly wealthier Indonesians and to use Indonesia as a manufacturing base to export to Western markets. This trend is underpinned by improving infrastructure and abundance of skilled labour.

During our recent visit in the region, we saw companies such as BYD, committed to invest in Indonesia to manufacture its EVs for the domestic and export markets. Indonesia has also seen increasing investment in AI infrastructure, as global hyperscalers (Microsoft, Amazon, etc) are increasing their presence in country.

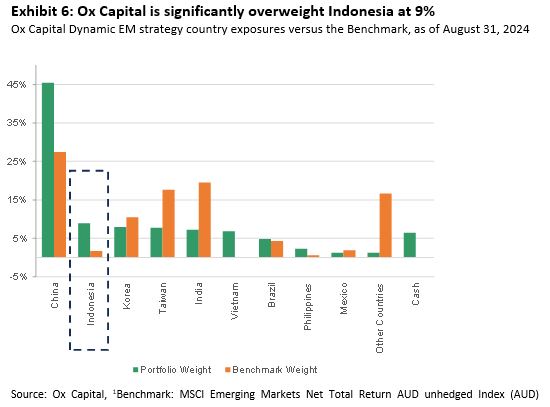

Our portfolio is significantly overweight Indonesia. At Ox Capital, across EMs, we look for companies that meet the “QGV” test:

That is, we are buying quality companies with strong, sustainable long-term growth outlooks at attractive valuations. For a stock to make it in our portfolio, there is a high bar to clear. We need to be comfortable and confident on the political landscape, macro environment, industry dynamics, company competitiveness, catalysts, and ESG considerations.

We own many names quality in Indonesia, which represents 9% of the portfolio as of September 30, 2024 versus the benchmark1 at ~2%; representing our second largest market weighting and second largest market exposure relative to the benchmark in our Dynamic Emerging Market Strategy.

Two of our top ten holdings are Bank Mandiri and Bank Negara Indonesia. Indonesian banks are experiencing robust growth, strong asset quality with minimal credit issues, and are generating high returns on equity, while trading at very attractive price-to-book ratios, and offering high dividend yields.

During our recent visit to Indonesia, we found that the economy, not under the radar of many investors, is in fact in great shape. We believe strong demand for loans, which are growing in the teens, can continue due to low levels of corporate indebtedness, as well as strong credit standards at our portfolio banks. These banks are generating over 15% to 20% returns on equity, trading at attractive valuations and are providing a large and sustainable dividend yields of ~6% underpinned by solid and responsible loan growth and its low-cost funding equating to net interest margin of 4-5%.

We believe now is the time to invest and take advantage of attractive valuations for quality franchises with profitable long-term sustainable growth across Indonesia & Emerging Markets.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.