How attractive are Chinese equities now?

Cheaper than the S&P during the financial crisis!

Even after the recent performance of the Chinese equity market YTD (CSI300 +11% / HSI +16%), Chinese equities are currently trading at very attractive valuations, and we believe the outlook for long-term investors is highly compelling. The government continues to implement new policies and initiatives to support the economy and restore confidence, and the economy is on track to achieve its 2024 growth target of around 5%. Many high-quality companies with sustainable growth in China are trading at depressed levels. Considering the significant disconnect between market sentiment and reality, Chinese equities are trading at valuations well below prior periods of economic challenges.

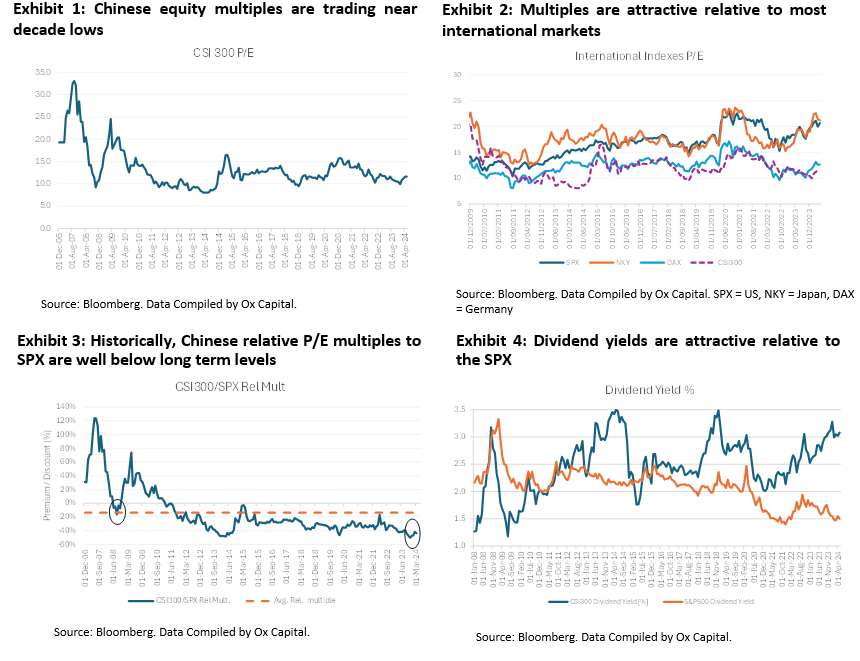

1. China is attractive relative to its history. The CSI300 index is trading at an average price to earnings multiple of 11x, below its historical average multiple and is near GFC levels.

2. The Chinese index multiple is much cheaper than those of international peers. The CSI300 multiple is trading at almost half that of the S&P500, a discount that is significantly below the historical average. In the 2000’s, the Chinese index traded at a significant premium to that of the S&P. However, the Chinese multiple today is at a significant discount to the S&P500, an even wider multiple spread than when the US went through its financial crisis in 4Q 2008!

3. Yields are attractive, with the CSI300 offering 3% yields, double the SPX. This spread has not been seen in almost a decade.

We highlighted in our February 2024 Insights, China reminds us of the Global Financial Crisis (GFC) in 2008 when theUS financial markets were under tremendous pressure and the economy was in a severe recession. In hindsight, a great time to buy US shares and position for the long term because even in a muddling through economy that followed, strong businesses still delivered earnings and stocks re-rated.

In contrast, China is not in a recession, but is simply growing at a slower rate. The economy is transforming from construction-led to become more technologically and consumption-led. With the bulk of the property sector adjustment already taken place, economic growth is likely to have bottomed from here. Growth will indeed exceed that of other major developed economies.

In China’s “muddling-through” economy, quality businesses with strong balance sheets, profitability and sustainable growth will continue to grow earnings. As sentiment improves, multiples will expand, which will likely drive significant share price appreciation.

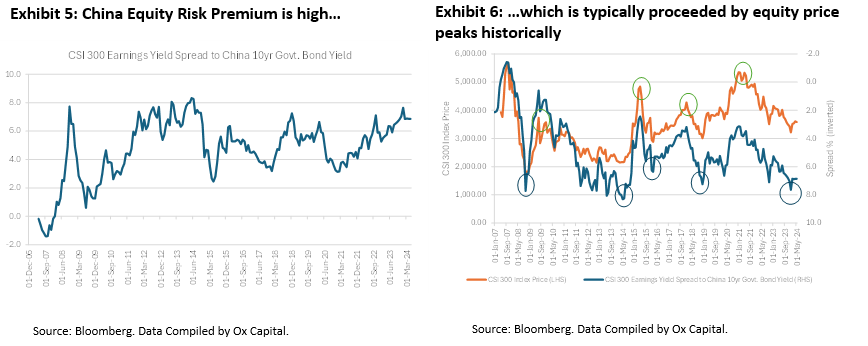

Lastly, we highlighted in our April 2024 Insights, in China, periods of trough valuations and high equity risk premium typically are followed by equity price rallies.

In conclusion, we argue China is very attractive on current valuation metrics and there is a clear disconnect in equity market valuations and its economic outlook. More importantly, the property market is showing signs of stabilising on the back of supportive measures from the authorities, and it is clear the government is dedicated to restoring confidence and reinvigorating the economy. The banking system remains healthy and resilient. Retail sales, exports, among other data points are all trending in the right direction. Household savings rates are one of the highest in the world and almost double that of major economies while consumption as a percentage of GDP is one of the lowest among major economies and policies will be put in place to drive a structural pick-up. Evidently, the technological-led transformation appears to be succeeding judging from the advances made by various industries such as EVs, batteries, solar panels, robotics just to name a few.

Now is the time to invest and take advantage of attractive valuations for quality franchises with profitable long-term sustainable growth.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.