Energy Production and Carbon Emission Pricing

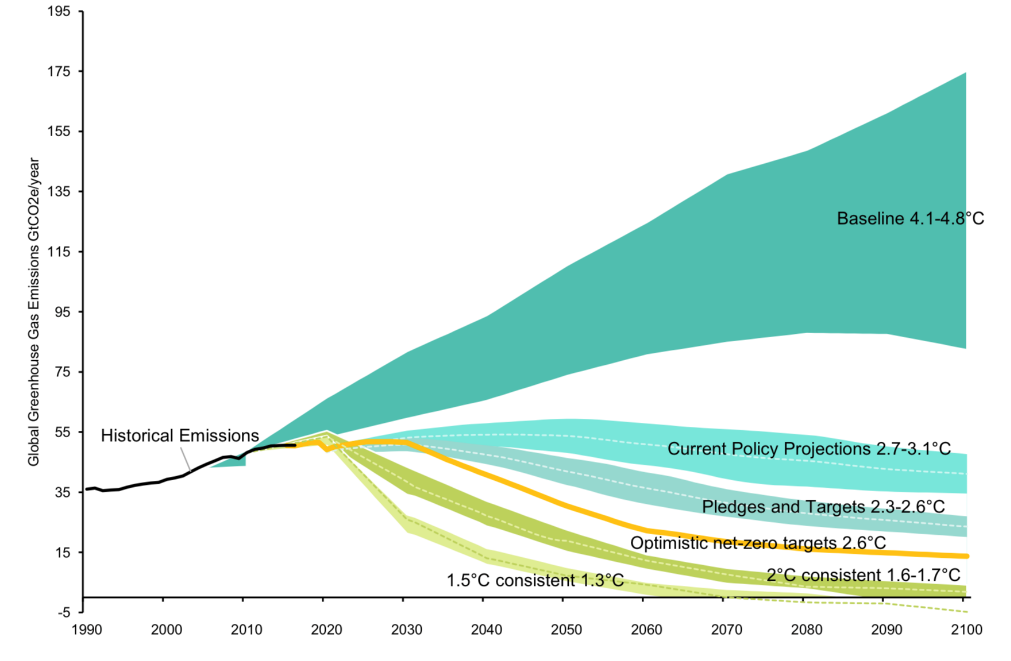

Climate change is a serious issue that has captured the attention of the world in the 21st century. The goal of fighting climate change is to keep average global temperatures rising within 1.5 degrees Celsius each year. This change is believed to be sufficient, although still not optimal, to stave off the worst consequences of climate change. To achieve this target, the net carbon equivalent emitted into the atmosphere by around 2050 must be zero. This is a huge undertaking, as not only can the world not increase carbon emissions from historical emissions, but we need to reduce carbon emissions all the way down to zero.

Figure 1: Projected Global Greenhouse Gas Emissions by 2100

Source: Bernstein analysis, Climate Action Tracker

The ability to harness cheap energy enables activities we take for granted. Cooking, different modes of transportation, manufacturing, and computing devices like the smartphone, all require energy. It is ubiquitous.

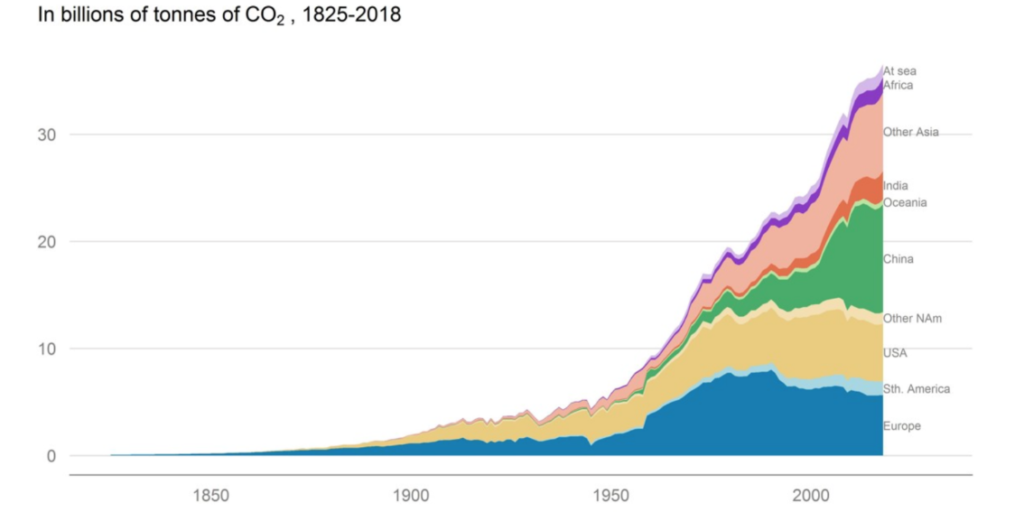

Fossil fuels have historically been a cheap source of energy that has enabled the industrialisation and economic development of the world’s most advanced countries. The growth of developing economies is also dependent on access to cheap sources of energy. Fossil fuels at historical average prices still remain highly attractive fiscally.

Figure 2: Annual carbon emissions, by region

Source: Carbon Dioxide Information Analysis Center (CDIAC), Global Carbon Project (GCP)

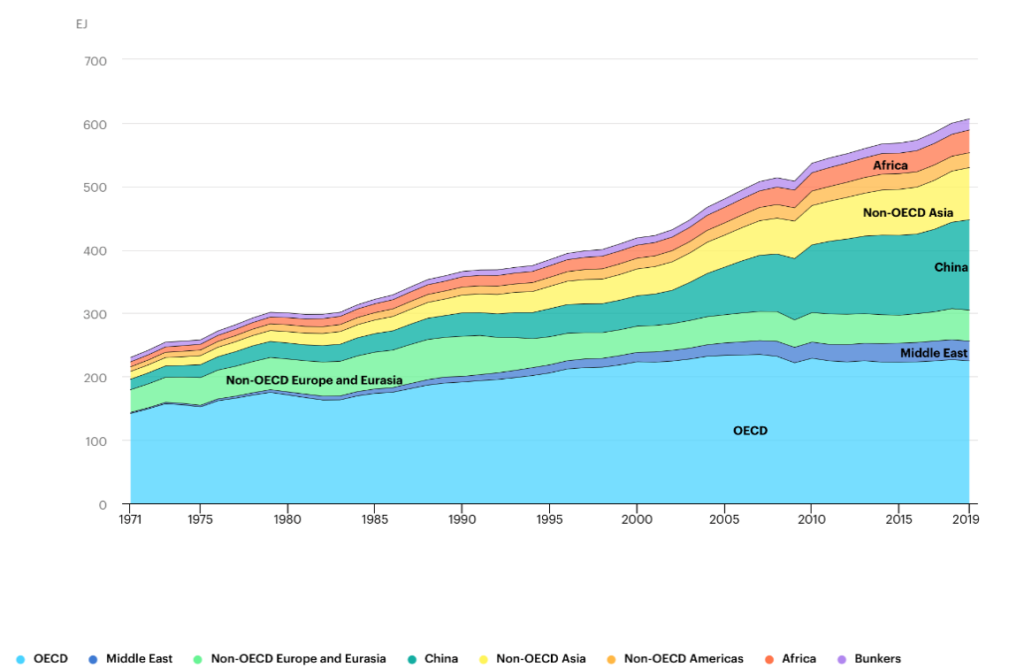

As energy is critical for economic development, global demand over the long-term has only really gone one direction: up. It is not likely that the overall demand for energy will decline in the future. In fact, the rising economic advancement of countries like India, China, and some African nations, will significantly add to demand for energy for decades to come.

Figure 3: World total energy supply by region

Source: IEA

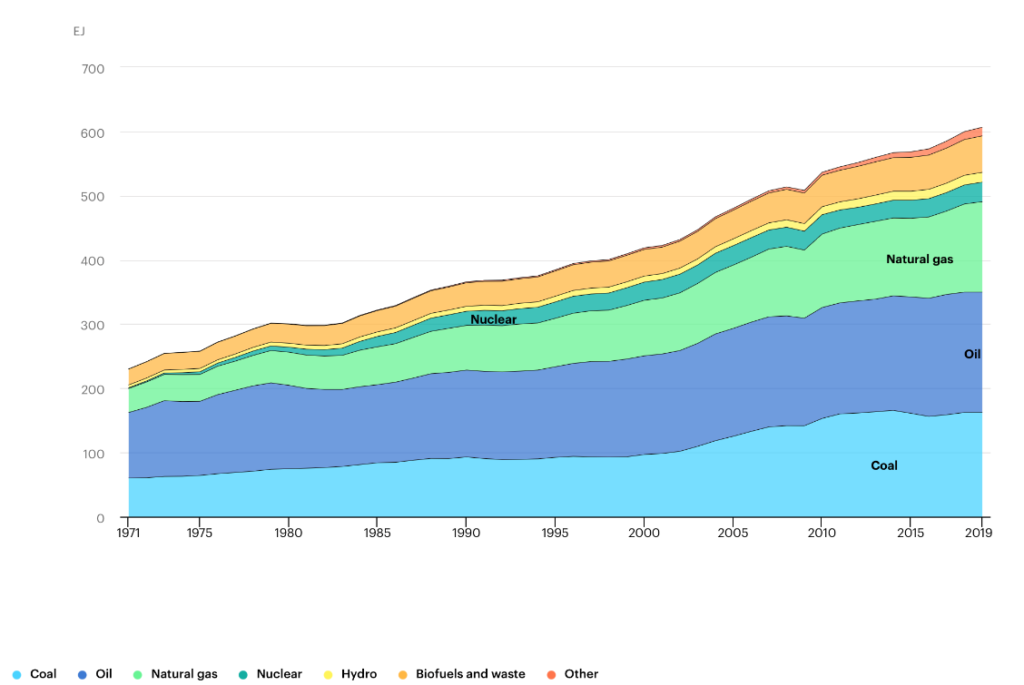

In order to achieve carbon net zero, when overall demand for energy continues to increase, we need to use energy that generates far less (or zero) carbon emissions.

Figure 4: World energy supply by source

Source: IEA

To reduce carbon emissions from fossil fuels, we can reduce the usage of them. We can use carbon capture technologies to stop carbon from escaping into the atmosphere. We can also increase the use of carbon sinks, for example planting forests, to increase absorption of carbon from the atmosphere back into plants to offset its usage. We can also invest in green technologies such as solar panels or wind turbines.

A great deal of new investment and changes in the way we run our economies globally is needed to achieve net zero. It is unlikely that the path to our net zero destination will be smooth and painless.

The most agreed upon method of achieving net zero is to put a price on carbon. That is, creating a market for carbon emissions. There are many variations of how carbon is priced. The cap-and-trade scheme is the most popular choice. Simplistically, this involves putting an annual cap on how much carbon dioxide is allowed to be emitted. This is then further broken down into caps specific to certain jurisdictions and industries. The companies producing more than their cap in a particular location or industry need to buy it from others with excess quotas. This encourages companies to invest in technologies to reduce carbon dioxide emissions, increase carbon sequestration, and reduce reliance on fossil fuel. Each year, the cap is reduced, and at different stages of the scheme, new industries are included. In many jurisdictions, the power sector is the first cab off the rank, and this in part explains why coal consumption is already peaking globally.

As the cap is made smaller, the price of carbon is pushed up by market forces. This incentivises the more marginal carbon dioxide producers to reduce their emissions. If enforced strictly, cap-and-trade schemes will lead to net zero at a given date, and for most jurisdictions, this politically agreed upon date is 2050.

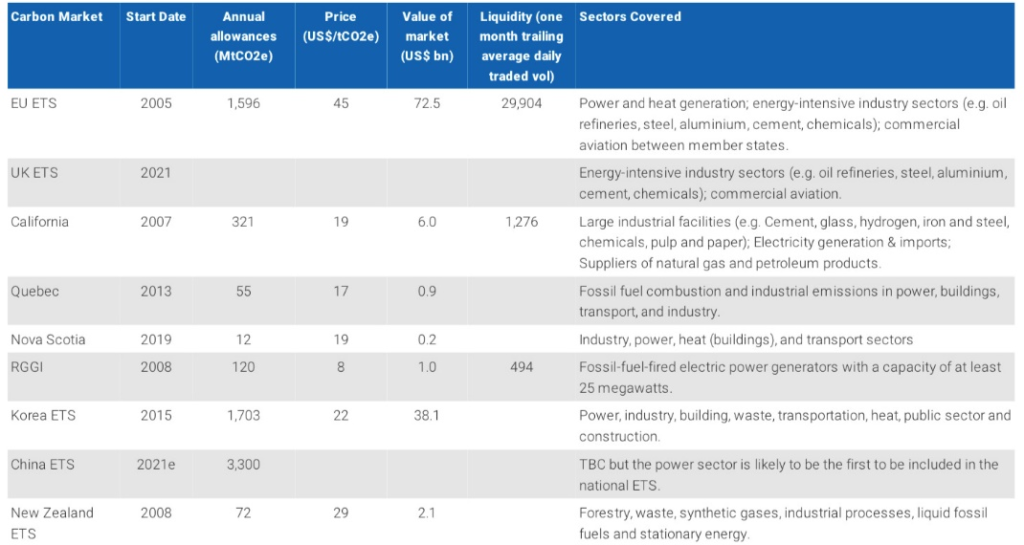

Table 1: Summary of the key carbon markets globally

Source: European Commission, California Air Resources Board, Quebec Government, Nova Scotia Department of Environment, RGGI, Eco Eye, New Zealand Government, ICAP, Morgan Stanley Research

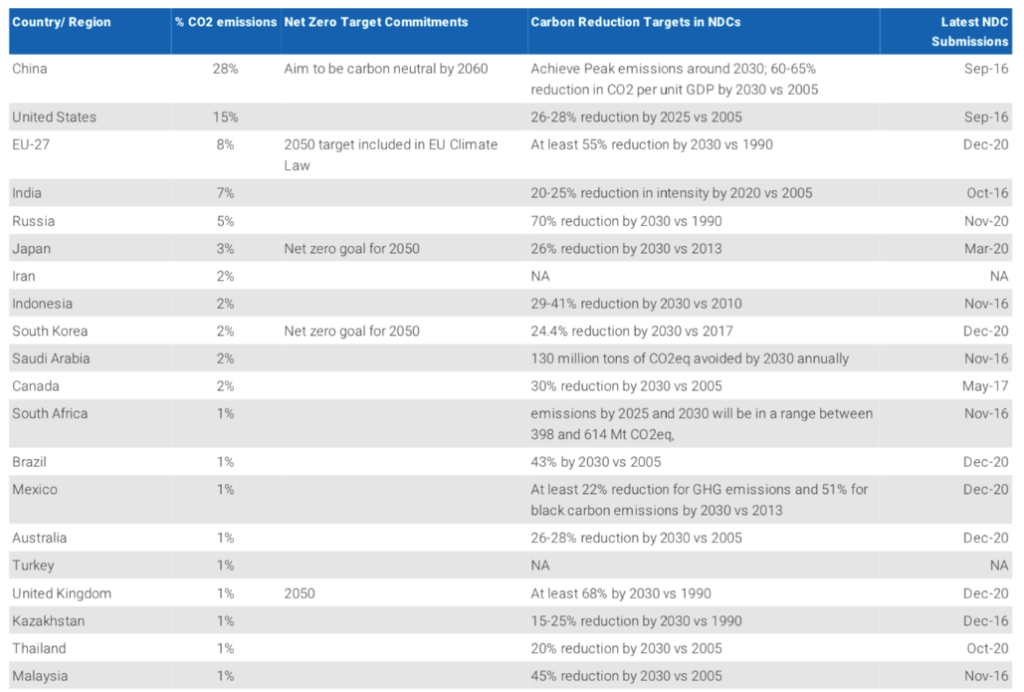

Table 2: Carbon Reduction Targets of 20 biggest emitting countries

Source: UNFCC NDC Registry, Morgan Stanley Research

Given not all countries are adopting emission trading schemes, and the schemes differ between countries, there is a problem of “carbon leakage”. That is, imported products manufactured from outside of their jurisdiction are not subject to carbon costs. Companies can game the system by moving manufacturing offshore.

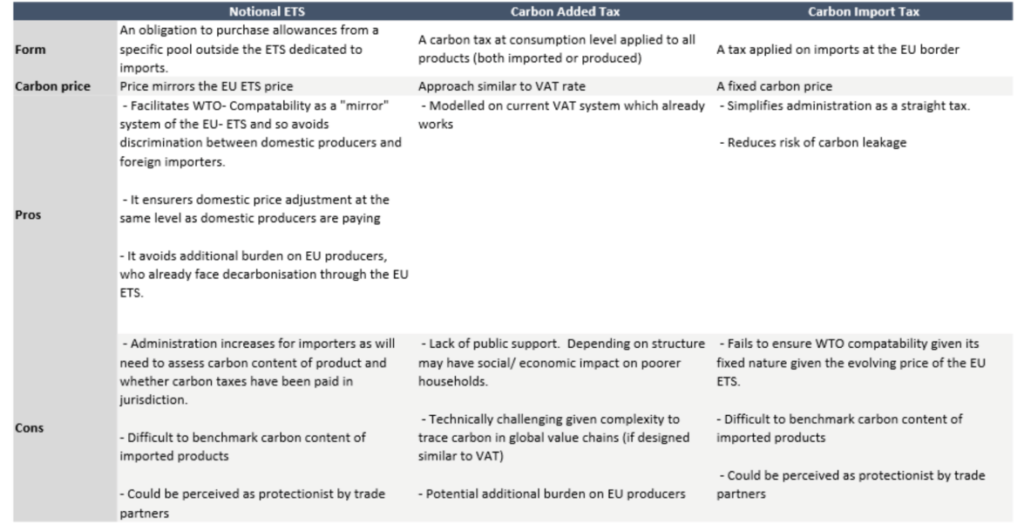

To address this problem, the EU has proposed the carbon border adjustment mechanism (CBAM). The exact mechanism and how this will work is yet to be finalised. However, the general idea is to levy some kind of tax, based on the market price of carbon, on imported goods. This tax will be higher or lower depending on the carbon intensity of the product, and the country where it was manufactured. This is likely going to be a very staggered process, however, has the ability to be very effective in the decarbonisation journey if adopted widely.

Table 3: Three options for the CBAM

Source: Morgan Stanley Research

Given the political, social, and scientific community’s determination to achieve net zero, it is likely that we will succeed. We may however have to face some unintended consequences.

Firstly, our work suggests that the desire to add production capacity for fossil fuels is currently very low. The community wants to reduce fossil fuel usage, in turn reducing oil and gas production and related infrastructure investment. This has resulted in a lack of capacity growth globally. Surprising to some, the constraint for capacity expansion is not the current carbon price, as the extraction of fossil fuel is not particularly carbon intensive. Even in Europe, the carbon price is not particularly onerous. Rather, the constraint comes from the social pressures and the shareholders of these energy producers.

It is difficult for executives to get away with investing in capacity expansion. Not only is it not socially acceptable, but there is a real concern that the any new investments will become stranded assets. Talking to many companies in the industry, it is not uncommon to spend just enough to maintain output, and the rest of the cashflow goes to renewables and dividends to shareholders. This attitude is not just prevalent in Europe but rather is a global phenomenon we are seeing playing out.

This dynamic is likely to lead to a periodic tightness in energy supply, as we are witnessing today. With the imposition of a heavy carbon tax on coal power plants for example, electricity must be generated from other fuels or renewables when this becomes unprofitable for producers. However, when the weather is unfavourable for renewable energy sources such as solar and wind, we may run into trouble. Alternatively, when winter is colder than normal and demand for heating jumps, we may see similar constraints. Given the lack of slack in the system, and the fact that gas and oil prices can suddenly shoot up, as they did during the northern hemisphere winter of 2021, we will likely continue to see dramatically higher energy prices all over the world.

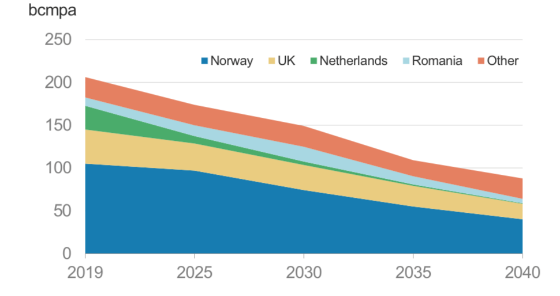

While Europe is planning to wind down its own production of gas, its reliance on gas from Russia is becoming ever the more substantial. There appears to be little incentive for Russian gas companies to invest in a buffer for Europe, given the expected increasing supply of the renewable energy production in Europe. Further, the Europeans have switched the bulk of their Russian gas supply to short term spot contracts, further raising the stranded-asset risk of the Russian producers.

Figure 5: European indigenous gas supply

Source: IHS

The problem is that while energy demand is rising globally, the degree to which the world weans itself off fossil fuels and matches this with new investments has not been sufficient. New investments in renewables and supporting grid infrastructure must offer a sufficient buffer for the fluctuations in supply and demand in order to be successful.

The energy system appears to have suddenly become very fragile. Variations in demand which would not have caused a problem before are now a problem.

The more structural issue of this dynamic is that the carbon-costed breakeven price of oil and gas investment is likely to be significantly higher than before. Previously, decisions were made based on pure dollars and cents, with little consideration into the environmental cost to the world and career risk of the executives. Fossil fuel prices will have to go up a lot more before new investment decisions are made. The carbon transition will likely continue against the background of structurally higher fossil fuel prices.

It is correct not to invest in coal mines, as demand is not going to grow from here. This is not the case for oil, and even less so for gas. According to the International Energy Agency, even under the most optimistic scenario, and one that will enable net zero 2050, demand for oil will not decline for roughly another decade, and gas for another two! Demand is set to grow for both oil and gas, and supply is not growing.

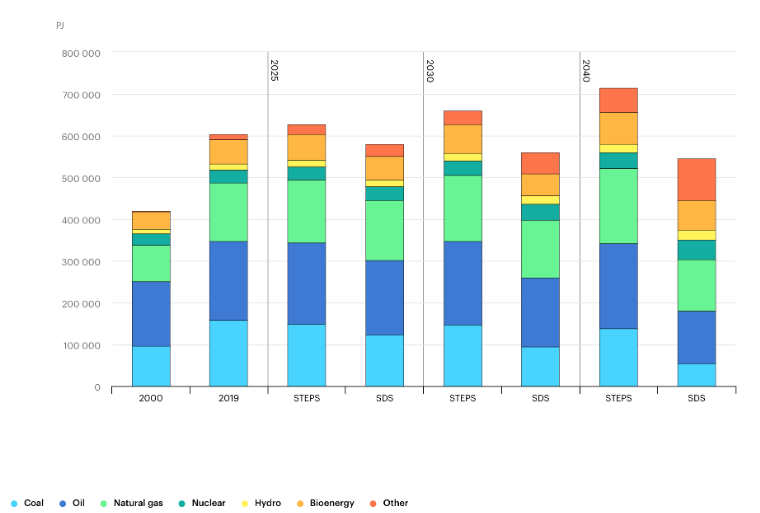

Figure 6: Total energy supply and outlook by fuel and scenario, 2000-2040

Source: IEA

Another unexpected consequence is what may arise out of China. China appears to be serious about tackling its environmental problems, namely high pollution and carbon emissions. China has even started emission trading and has put in place environmental criteria for assessment of local government officials. The cost of pollution has gone up for the good of society.

China will no longer be growing production of polluting and energy intensive products for the rest of the world, effectively reversing the last two decades of importing pollution, exporting deflation while piling up corporate debt. This can have significant consequences for the entire world.

To conclude, faced with rising demand and stagnant supply, fossil fuel prices are now following a classic upward price cycle. Underinvestment has been significant over the last five years, and it was worsened by COVID-19 in 2020. A higher fossil fuel and carbon price is positive for the deployment of renewables, and renewables costs have become more attractive in absolute terms. Strong cashflows enjoyed by oil and gas companies under the current high energy price environment will also be gradually redirected to more sustainable sources. These measures will in turn facilitate a transition to a net zero environment, given the environment, social and political focus remains in place.

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.