Emerging Markets are offering one of the biggest opportunities in a lifetime

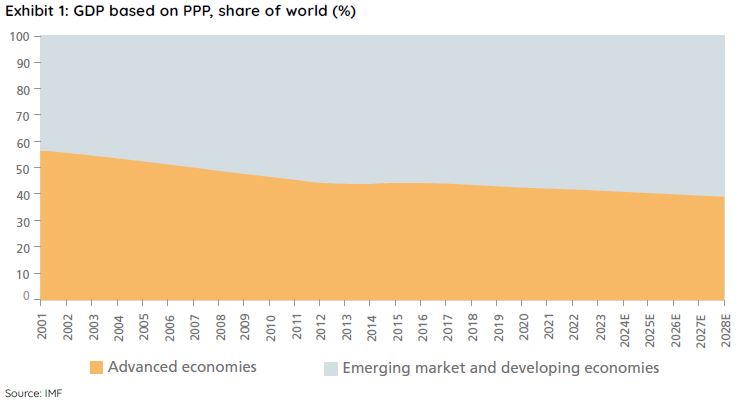

The term “BRICS” was coined in 2001, and it refers to a collection of developing countries – Brazil, Russia, India, China and South Africa. Since then, the BRICS nations’ share of global GDP (based on purchasing power parity) has surpassed that of developed economies, contributing to over ~60% of global GDP. China for example, grew its share of world GDP (PPP) to ~19% from ~8% in 2001. While China’s growth is more mature, many other emerging economies are poised to continue the economic catch-up, as these economies still have relatively low-income per capita levels, and growth is driven by sound economic policies.

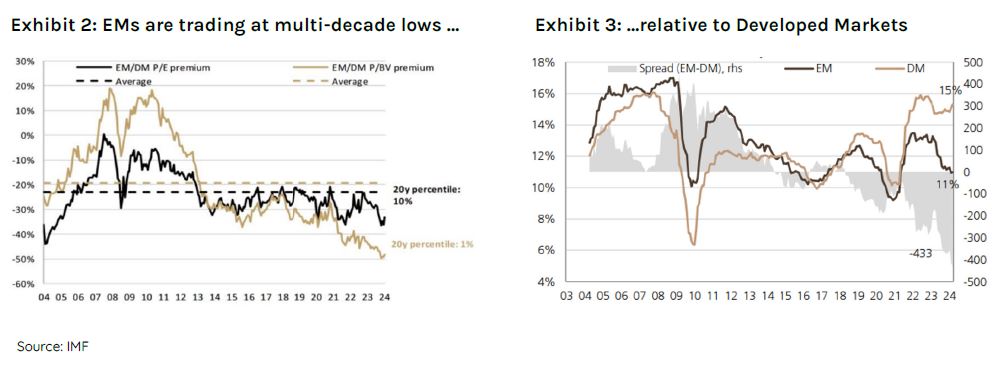

Notably, emerging markets equities are at a multi-decade low in price to earnings and price to book valuations compared to that of developed markets. It is an important fact given EM equities have historically outperformed developed market over the long-term. A general lack of interest has led to extraordinarily appealing valuations. We are looking at an attractive entry point with forward price to earnings multiples at depressed levels for quality companies with sustainable long-term growth and a backdrop supportive of outperformance.

Moreover, many EM economies are undergoing continued economic development and political reforms. The economic fundamentals are much better than in prior years. Inflation is trending lower in many EMs allowing central banks to cut rates. A slowing developed markets economy is set to benefit emerging economies as we believe a slowdown in growth for the US will lead to interest rate cuts. Additionally, a declining US dollar and official interest rates are set to benefit emerging market equities.

The recent period of underperformance for emerging markets, is an outlier in our view. EM economies were much more indebted and starting valuations were high over a decade ago. The present outlook is vastly different. Fiscal balances are healthy while debt to GDP ratios are at stable levels. Corporates are in a healthy position. Moreover, many EM regions are rich in key commodities for the upcoming Net Zero energy transition. We remain optimistic on emerging markets and believe the fundamentals are in place for EMs to outperform developed economies.

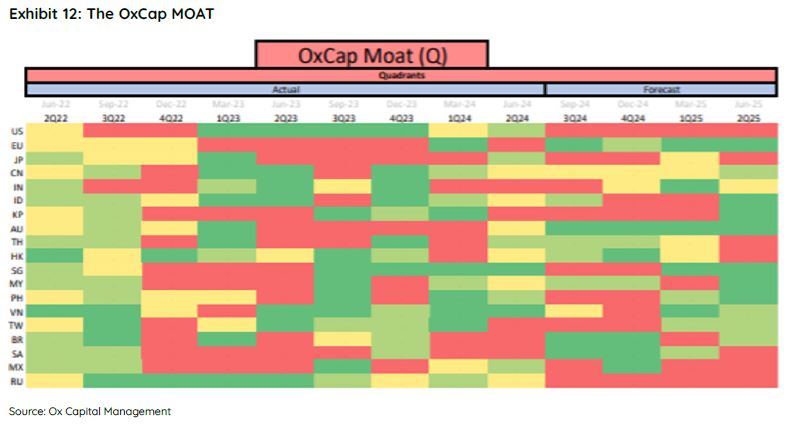

Our proprietary quant model (the MOAT) is pointing to a very difficult environment for many developed markets into 2H2024 into 2025 including the US, versus an improving outlook for many EM countries, including China. Ox Capital is positioned now to benefit by investing in quality companies with sustained growth at attractive valuations across EM countries. In a volatile environment such as the one we are in; it is important to try to hedge the volatility. Ox has the capability to manage the portfolio dynamically that has reduced volatility in the past.

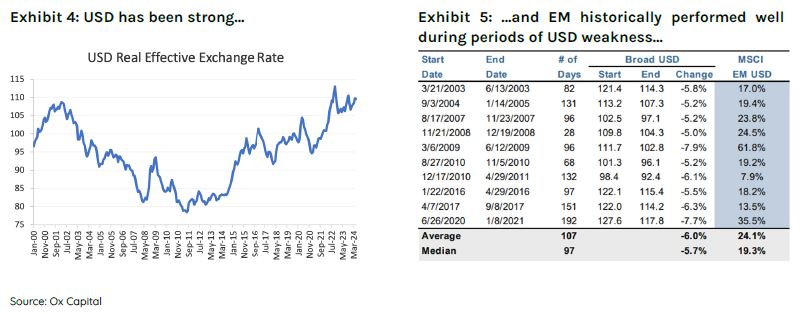

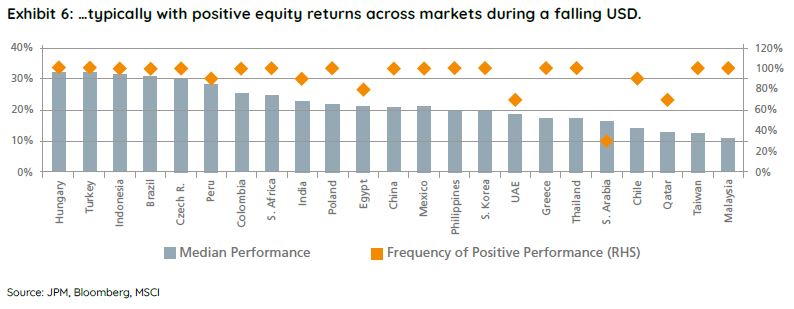

Theme 1: A weaker USD

The US interest rate hikes by the central bank (Federal Reserve) has driven a stronger US Dollar. The recent strength of the “greenback” has been a headwind for emerging economies. This is logical as a stronger dollar can impact capital flows, trade, direct investment, and can impact credit growth. We believe the eventual decline in the USD will provide a tailwind for emerging market equities as returns are typically higher when the USD is declining in value. Historically, EMs outperformed the market by ~20% on average over the period since 2003.

Theme 2: Rate Cuts

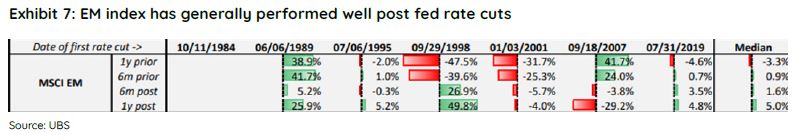

The US federal funds rate has peaked and the FOMC is likely to cut rates as inflation moderates within its targets range. EM markets have historically performed well when the US cuts interest rate. Moreover, local central banks have been fiscally responsible. Many central banks have already started to cut official interest rates as inflation has trended back towards many central bank targets. Rate policy looks too restrictive, and cuts are likely to continue.

Theme 3: Supply chain reconfiguration and nearshoring.

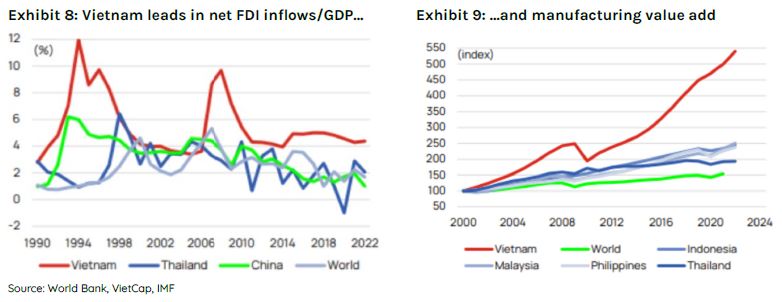

A reconfiguration of global supply chains will boost economic growth for a number of economies, especially nearshoring in ASEAN and LATAM, boosting GDP growth through foreign direct investments. Vietnam is a notable beneficiary of this trend. Greater foreign direct investment into an ever more open and market driven economy, with some of the most comprehensive free trade agreements in place globally, is providing strong employment opportunities for this young and vibrant country. As such, we believe this backdrop provides a foundation for alpha generating opportunities.

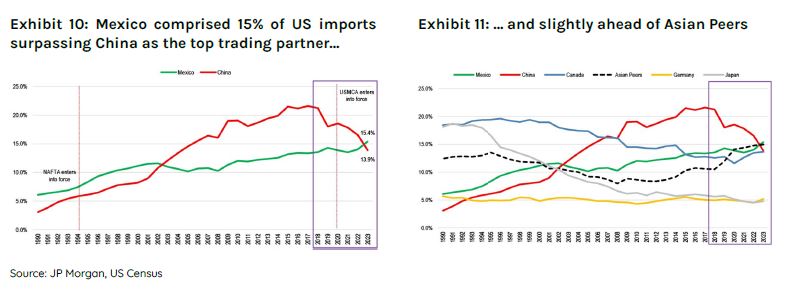

Moreover, nearshoring is a significant opportunity for the LATAM region in the coming years based on their geographical proximity to North America, and relatively cheap skilled labour. Nearshoring could add US$78 billion per annum in additional export revenue in LATAM in the coming years with Mexico being the primary beneficiary. Trade is especially important for Mexico. Mexico relies heavily on its industrial sectors for exports, with the manufacturing sector representing >80% total exports.

Mexico’s manufacturing sector has grown and matured over the years. Most recently, the top three export categories include auto-components, electronics, and machineries. Mexico is well placed with its long-established export capabilities to fulfil manufacturing orders for an increasing number of international companies. Mexico’s relationship with the US is already well-established, as it is the largest exporter to the US. The country’s ~15% share of US imports has now surpassed China’s ~14%.

Growth in developed economies is expected to slow as rates have likely peaked. In contrast, despite recent economic challenges, the Chinese economy is expected to grow faster than the US, Japan, and Euro Area. Although China’s growth is lower than in recent years, its economy is showing signs of bottoming, on the back of the Chinese authorities showing a willingness to stimulate and support the economy. Keep in mind interest rates in China are low with minimal inflation relative to the rest of the developed world. A positive set up for equities in the year ahead. Moreover, Emerging countries make up the bulk of global growth, contributing to over ~60% of global GDP, but is under appreciated by global investors.

Our risk management framework at Ox Capital relies on both quantitative and fundamental, bottom-up analysis along with our experience to deliver actionable, alpha generating ideas. The MOAT (Macro Overlay Aggregate Tracker), our propriety quantitative model, is pointing to a promising environment for EM growth in 2024, especially China, as inflation in many markets is stable to declining.

We believe we are at an inflection point for EMs and the current valuations are providing an attractive entry point. A declining of US rates and the US Dollar benefit emerging markets valuations. In China, the government is focused on positioning the economy for long term growth. In addition, there is also a greater sense of urgency to support consumption and mitigate risks (such as property and related sectors). The expectation from the regulators is a gradual recovery in 2024 that accelerates in the 2H.

Now is the time to invest and take advantage of attractive valuations for quality franchises with profitable long-term sustainable growth across Emerging Markets.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.