DeepSeek shocks the AI world

A high performance, low cost, open-source contender sparks debate

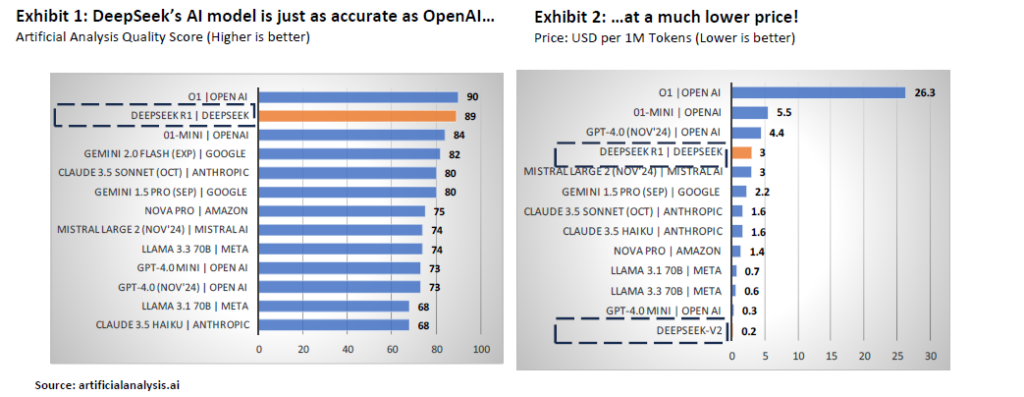

The Chinese AI model DeepSeek has made waves with the release of its latest version (R1), which has

stunned the AI community. When compared to other top-tier models like ChatGPT, DeepSeek’s performance

stands on par, but with a significant advantage—its cost is far lower for end users and software

developers.

There’s little debate about DeepSeek’s capabilities. As an open-source model, it’s fully accessible to the

public, including the model and the techniques used to develop it. While DeepSeek introduced some of its

own innovations, the core methods it employed are widely available within the AI community.

AI research is constantly evolving, with breakthroughs happening regularly. These advancements paved the

way for DeepSeek’s development. What’s truly surprising, however, is that an open-source model like

DeepSeek can match the performance of the most well-funded, closed-source models.

From a technical standpoint, DeepSeek’s architecture is designed to maximize performance per unit of

compute, which in turn lowers costs while maintaining world-class capabilities.

This development has raised several important questions:

- Open Source vs. Closed Source: While models like ChatGPT (OpenAI) and Google’s Gemini are closed

source, Meta’s Llama and DeepSeek are open source. Which approach will prevail? - AI Capital Efficiency: With AI capital expenditures skyrocketing into the hundreds of billions annually,

can efforts spent on optimizing the performance of semiconductor chips significantly lower both

capital and operating costs? - New Competitors in the AI Space: Could the large language AI model industry be disrupted by a surge

of new challengers? - Can China Keep Up?: With increasingly stringent export restrictions on advanced AI chips, can Chinese

companies continue to make strides in AI? DeepSeek, a Chinese startup, has proven that it can

compete with the best, despite these challenges.

What is the probable outcome?

One likely consequence of DeepSeek’s success is that Western companies may adopt some of the techniques used to lower AI costs. This could lead to a reduction in the cost of both training AI models and running inferences. In the medium to long term, this reduced cost will likely drive greater user adoption. For example, the cost of producing AI agents could become much more affordable, benefiting AI-driven workers and robotics development.

The rise of DeepSeek mirrors trends seen in other industries. Historically, when China has faced restrictions on critical technologies and manufacturing equipment, innovative domestic companies have emerged to overcome these barriers. In sectors like robotics, 5G, software and semiconductors, prospects of similar restrictions have led to the development some of world-leading Chinese manufacturers.

The good news is that DeepSeek is open source. With detailed research papers and available code, other researchers and developers can study and build upon the techniques, ultimately advancing AI for the greater good of humanity.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.