DeepSeek is much more than the Sputnik Moment

Chinese Innovation Eats the World!

The introduction of DeepSeek into the market exemplifies the technological advancements that Chinese companies have achieved in recent years. Through company visits and discussions with local experts, we are seeing significant technological advancements in China. These developments are partly driven by necessity, in response to increasing restrictions from its global competitor, the United States.

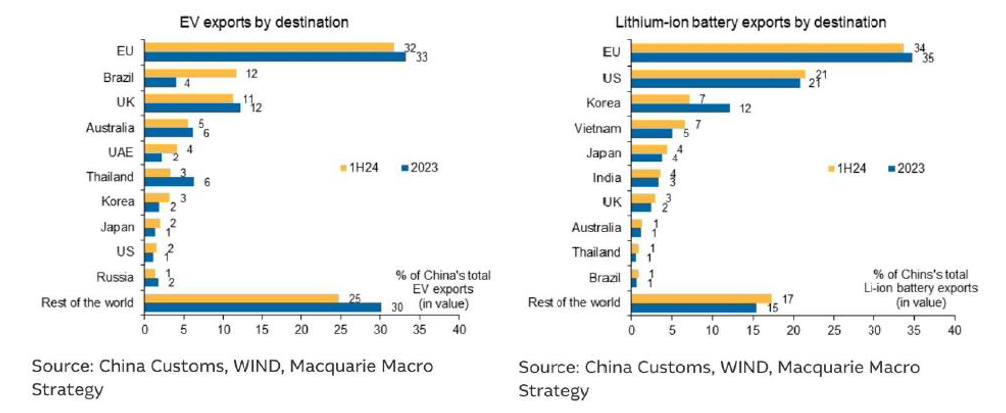

In addition to DeepSeek, platforms like TikTok and Temu have grown on Western consumers. They are leapfrogging the traditional internet platforms and driving convergence in social and e-commerce. Beyond these visible changes, there are numerous technological advancements that may not be immediately apparent to consumers. These include developments in robotics, electric vehicles, batteries, renewable energy such as solar and wind, and nuclear energy.

The advancements have been made possible through rapid iterations of product designs, driven by intense competition. Notably, these waves of innovation and cost reduction are not the results of top-down directives but rather classic Darwinian competition. Weaker domestic players have been eliminated, allowing stronger players to survive and evolve into globally successful companies.

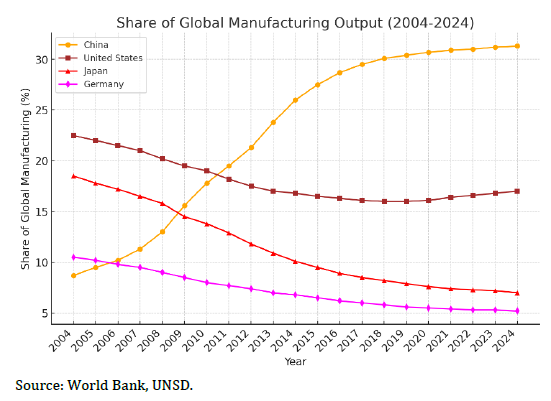

The large domestic market, availability of low-cost and skilled engineers, access to capital, and affordable infrastructure have contributed to China’s significant share in global manufacturing. China accounts for about ~33% of global manufacturing capacity, exceeding that of G7 countries combined. This percentage is expected to grow as Chinese companies make progress in new (and higher value) industries. Consequently, the economy can produce a wide range of products at very low cost at scale, except for high-end semiconductors (at present).

With its huge, educated work force, ample spare capacity, and large domestic market, entrepreneurs are afforded a runway to build great businesses. For instance, a hedge fund manager has managed to innovate and develop DeepSeek, a cost-effective AI solution. Similarly, several Chinese companies are poised to become significant players in robotics and are likely to be major suppliers of robotics components globally. Robotics may be the next high tech success story in China, following the footsteps of the domestic EV makers.

The challenging transition in China was due to a realization by domestic authorities that the ever-expanding construction sector would eventually lead to negative consequences for the economy. Therefore, a shift towards quality and sophisticated products was deemed necessary. This transition is nearly complete, and the benefits of these efforts are expected to emerge as these new growth sectors begin to offset the decline in traditional industries such as property construction, which has experienced a significant reduction of approximately 70% from its peak.

The re-orientation towards quality has resulted in local players gaining market share in almost all industrial and technological sectors domestically. This trend may extend to the rest of the world, depending on trade dynamics in the coming years. The cost and quality advantages of Chinese cars, batteries, robots, and AI are expected to be highly appealing globally. While some countries may choose to block BYD or DeepSeek, they will be stuck with gas guzzlers and expensive AI models while the rest of the world get to benefit from having stronger ties with China and its companies!

At Ox Capital, we own a number of innovative businesses in China that we believe will become global champions. We firmly believe we own companies that are going to disrupt industries rather than those that will be disrupted. Given the negativity that is still prevalent on Chinese (particularly in Hong Kong) shares, the plethora of opportunities is too good to ignore!

At Ox Capital, we own a number of innovative businesses in China that we believe will become global champions. We firmly believe we own companies that are going to disrupt industries rather than those that will be disrupted. Given the negativity that is still prevalent on Chinese (particularly in Hong Kong) shares, the plethora of opportunities is too good to ignore!

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.