China undertaking “QE”, US rates peaking

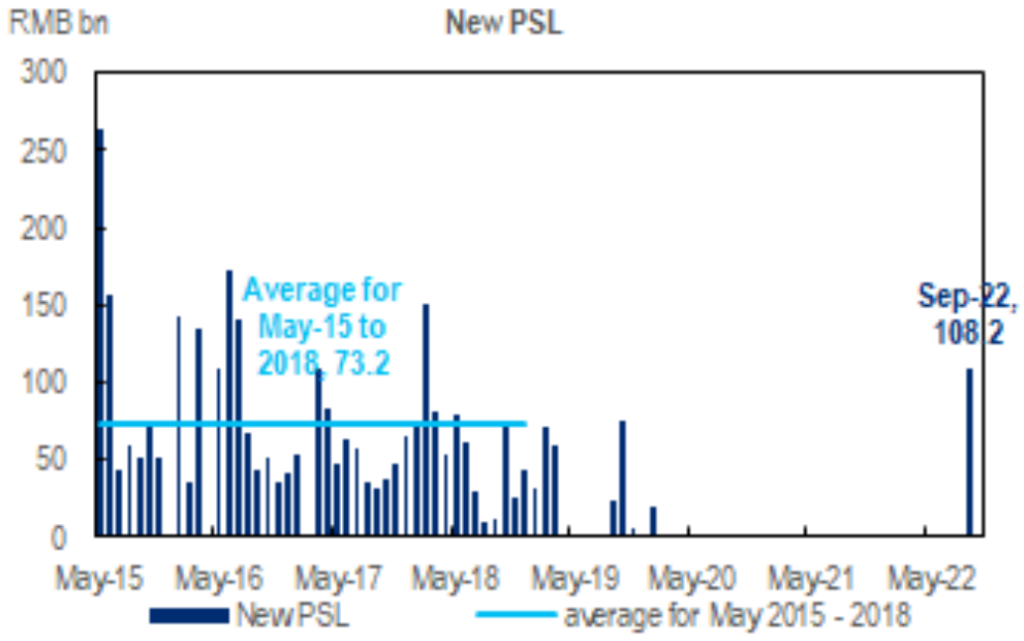

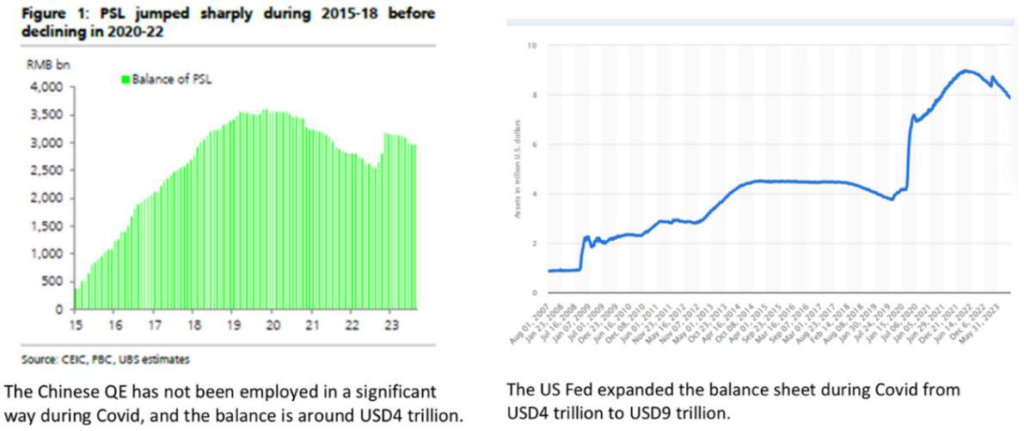

Driven by the lacklustre recovery, the Chinese government is loosening policies in a rapid pace. On top of the loosening of policies in properties and expansion of the Central Government fiscal deficit, the Chinese Central Bank reportedly plans to provide at least RMB1 trillion of pledged supplemental lending (PSL, the Chinese version of QE) to better support and restore confidence in the economy. The sum is likely to be spent on urban renewal projects and affordable housing programs and infrastructure across the nation.

The significance is that, after a hiatus of a few years, Chinese QE is set to ramp up again. This is positive to Chinese equities, as it signifies a willingness of the authorities to support economic growth if needed.

The PSL facility, originally set up in 2014, involves the Central Bank funding and directing policy banks to undertake specific projects. In prior periods, when the PBoC intervened via PSL, it successfully restored confidence and revigorated the property market. PSL was gradually curtailed post 2017 during China’s deleveraging campaign.

The extent of QE in China and USA possibly explains the differing levels of economic strength and inflationary pressures, with China struggling with economic growth and USA confronted with inflation!

China is transitioning from an investment led economy to one that is driven by high value sectors and consumption. The property market will likely remain weak as the sector expanded incessantly over the years. Local governments are also hurting from declining land sales. Amelioration will require fiscal reforms which the authorities are well aware of.

Importantly, the banking system remains well capitalised, the current situation in China is far from that of a crisis. The global financial crisis more than a decade ago in the developed economies involved gargantuan banking system losses, amplified by derivative instruments, cascaded through the banking system. The Chinese banking system is only temporarily stunted despite controlled implosion of the property sector by the government. Further, as the vast majority of losses are denominated in RMB, the printing press can be readily cranked up if required.

With China re-starting “QE” now, it is important to consider and act now. While the magnitude of the “QE” is not entirely clear ultimately, the regulator’s focus on growth suggests there may be more to come. Valuations for quality fast growing companies in China are compelling. Even in a muddling-through scenario, they will do well and generate attractive return for investors!

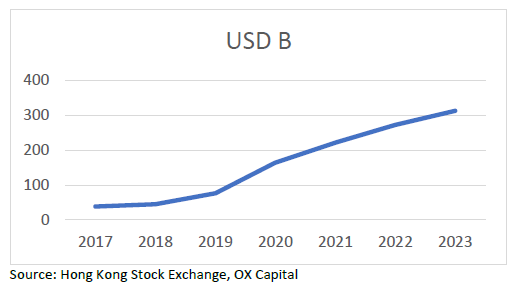

Valuation is extremely cheap, stabilisation of properties, QE, Chinese capital replacing international flows in Hong Kong equities market (USD300 billion thus far) and geopolitical stabilisation are the catalysts.

US 10 year bond yield appear to have peaked. Source: Bloomberg.

Chinese Renminbi may have found a bottom which is positive to risk assets. Source: Bloomberg.

At Ox, we are focussed on the quality companies with long term growth at inexpensive valuations. Current valuation is providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

This material has been prepared by Ox Capital Management Pty Ltd (ABN 60 648 887 914 AFSL 533828) (OxCap). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed.