China Rejuvenation

Innovation, Manufacturing, & Global Leaders

We are witnessing a remarkable transformation in China, shifting from an economy driven by construction and urbanization to one increasingly fuelled by innovation and quality. The transitional pains that we have witnessed are approaching the end and there is light at the end of the tunnel.

Over the past two decades, China had a simple model of growth: construction of infrastructure and properties. Today, Chinese cities are modern, and many tier 1 cities already resemble the cities of the future. To build more properties in increasing scale will lead to significant over-investment. The transition to innovation and higher productivity gain are essential.

It was no easy task to “course adjust” the huge Chinese economy, but it appears to have succeeded. An array of Chinese industries has emerged as global leaders. The transition is very much on track.

The Chinese economy is not a monolithic structure, but a diverse collection of individual economic units, each pursuing its own self-interests in a capitalistic way. The most vibrant part of the economy is the private enterprises, which compete fiercely against each other to succeed in their respective industries. The potential rewards for winning in this vast economy are immense.

The champions who emerge from the fiercely competitive domestic market thrive in the global markets. These companies have leveraged efficient infrastructure, the world’s most comprehensive and cost-effective supply chains, and an abundant pool of skilled engineers in the world. The Chinese culture is open and many of its citizens have travelled, studied and worked in developed countries. Many Chinese businesses are adept in extending their strengths in China into the global marketplace.

In recent months, the world has witnessed the rapid ascent of Deepseek, global expansion of BYD’s EV sales, and DJI’s dominance in the drone market. Meanwhile, China’s robotics supply chain is on track to lead humanoid robotics manufacturing in the coming years. The country is also a global leader in renewables, including solar panels, wind turbines, and batteries. Doing business with other countries, be it the Global North or the Global South is not something that fazed the Chinese entrepreneurs.

China’s export profile has shifted significantly. The country now exports more high-value-added products—such as EVs, solar panels, and batteries—and has diversified its export markets. Trades with developing nations has surpassed trades with the U.S. and Europe. For example, despite having minimal presence in Western car markets, China has emerged as the world’s largest auto exporter.

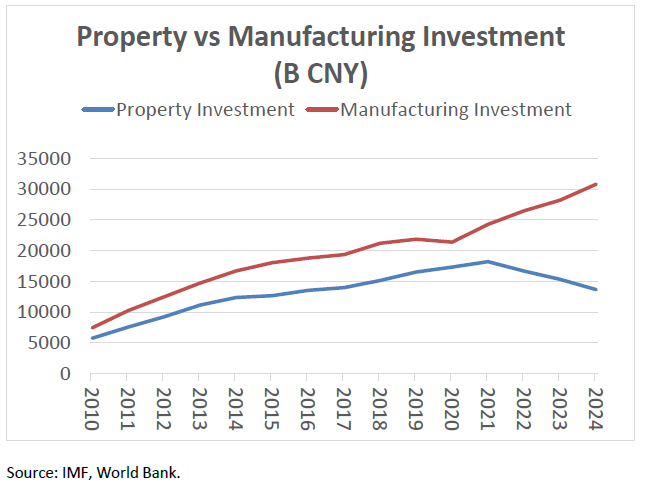

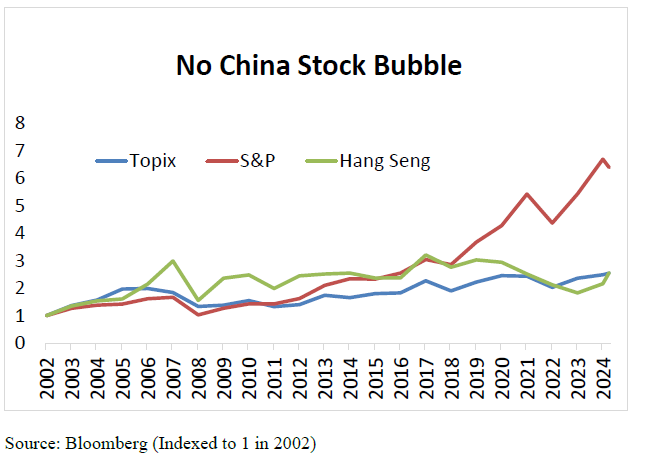

Transitioning from an investment-led economy is always going to take time, and the stock market has suffered as a result. Over the last five years, investment in the economy has shifted away from property development to manufacturing. Having endured the most challenging phase of the shift, the economy is now positioned for more sustainable, albeit moderate, growth moving forward.

An ever-expanding real estate market was never going to be sustainable. Government stepped in and intervened. Capital was redirected—through administrative measures and interest rate adjustments—toward the manufacturing sector. China’s industrial sector has not only grown but has also become even more cost-competitive through automation and robotics, solidifying its global leadership in key industries.

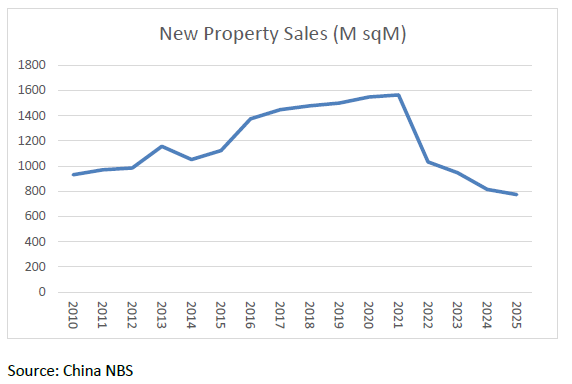

The property market adjustment has been dramatic. Primary property sales have dropped more than 50% from their peak, reaching levels not seen in over 15 years. Given such sharp decline, it’s no surprise that growth moderated in China. Despite steady growth in GDP and electricity consumption, workers in traditional investment-led sectors had to contend with higher unemployment.

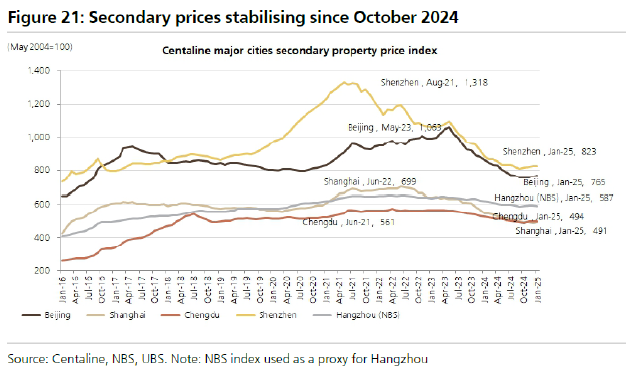

The good news is that the drag from the slowing property market is likely to ease in 2025 and beyond. Much of the adjustment in sales volume and pricing has already taken place. In many Chinese cities, rental yields are now comparable to or even better than mortgage rates, which is supporting property market activity.

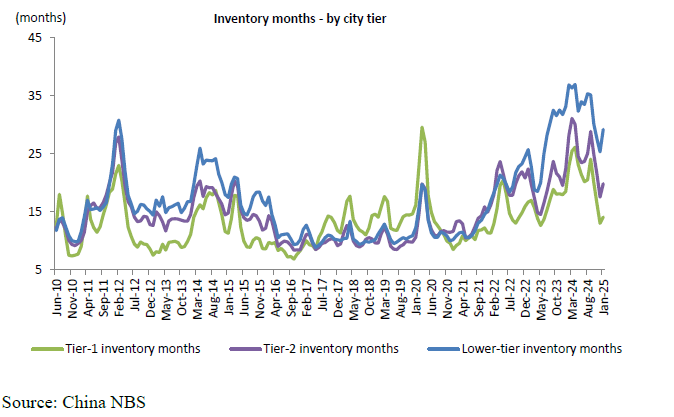

In the more dynamic cities, secondary prices have stabilized. Inventory of unsold apartments has adjusted to healthy levels. Combined with declining mortgage rates, which are now roughly equal to rental yields, conditions are in place for a recovery in property sales.

To be fair, some part of the property market remains work in progress. There is an oversupply of housing in less economically vibrant cities. During the property boom years, many properties were built in economically less viable cities supported by speculators. The property adjustment therefore led to an adjustment period, which has been painful but necessary.

After a few years of adjustment, sales and new housing starts now back to pre-2010 levels, the market appears to be stabilizing, with an eventual recovery likely.

Some comparisons have been made between China’s current economic conditions and Japan’s post-bubble stagnation. However, these comparisons are misplaced.

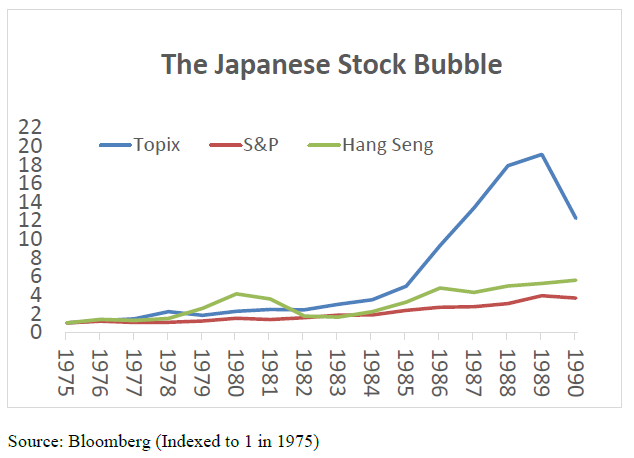

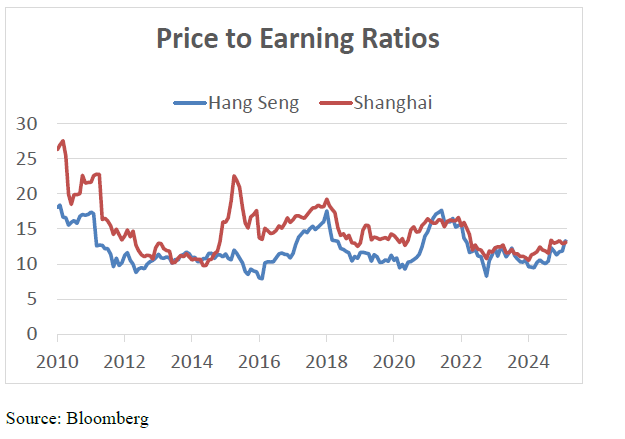

Japan’s “lost decade” followed the bursting of massive stock and real estate bubbles. During Japan’s bubble, it was famously said that the real estate value of the Tokyo Imperial Palace exceeded that of the entire state of California, and Tokyo apartment prices were multiple times those of Manhattan! The Japanese stock market was on 70x price to earnings multiples at its peak. The collapse of these huge asset bubbles led to significant negative equity for corporates and households, triggering a prolonged adjustment process, the lost decades of Japan.

China, by contrast, has not experienced such extreme bubble conditions in recent years. Its stock market has been lackluster, and while property values were high, they were never at the unsustainable levels seen in Japan’s 1980s boom.

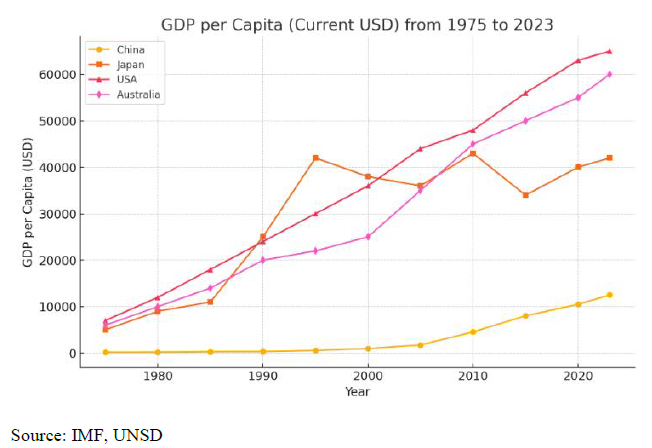

Another point of difference is that Japan’s economic bubble was so extreme that its GDP per capita significantly exceeded that of the U.S. at its peak. In contrast, China’s GDP per capita remains low, leaving considerable room for catch up which is evidently taking place, with the Chinese private sector having successfully climbed the technological ladder. Many of China’s domestic champions are on track to become global leaders. As these industries develop, they will undoubtedly drive further increases in China’s GDP per capita.

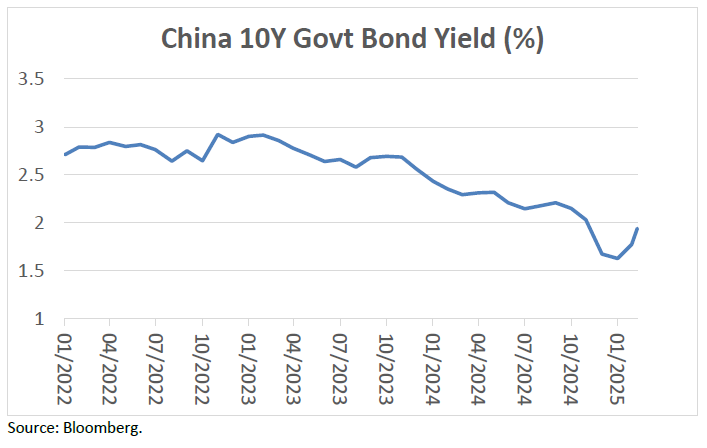

Having taken on the many challenges in recent years, a cyclical recovery is now underway— despite the Central government refraining from launching its infrastructure stimulus plan. Of note, after years of declining 10-year government bond yields, which signals deflationary pressures, yields have begun to rise. This suggests that economic activity is picking up and that a broader recovery could unfold in the coming months.

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.