China Property: Has the “Grey Rhino” been tamed?

Stabilization of property market in sight = Time to buy quality growth stocks in China.

Relative to most governments in the world, the Chinese authorities proactively controlled and deflated the property

market bubble to sustain a stable economy in the long run. Policy measures, including tighter lending standards and

house price restrictions, were put in place to dampen real estate speculation while containing escalating home and

land prices. Notably, latest statistics from China indicate signs of stabilization in the property market.

1. Policy measures have been effective: Measures put in place over two years ago have been effective and

authorities have started relaxing some policy measures given :

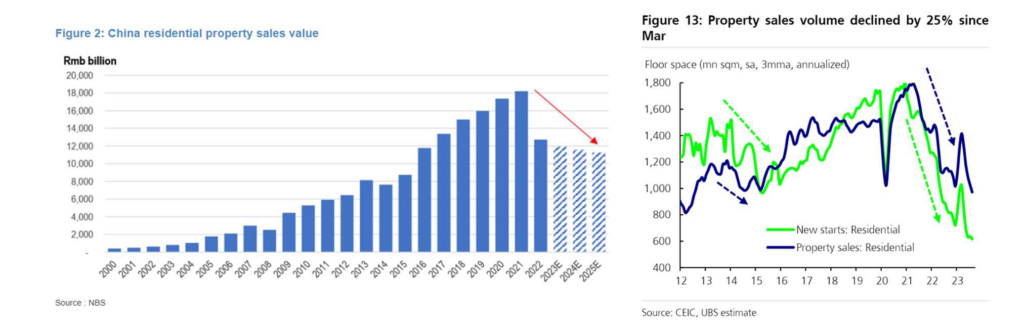

1) Property sales are down ~50% from 2021 levels (near 2015 levels).

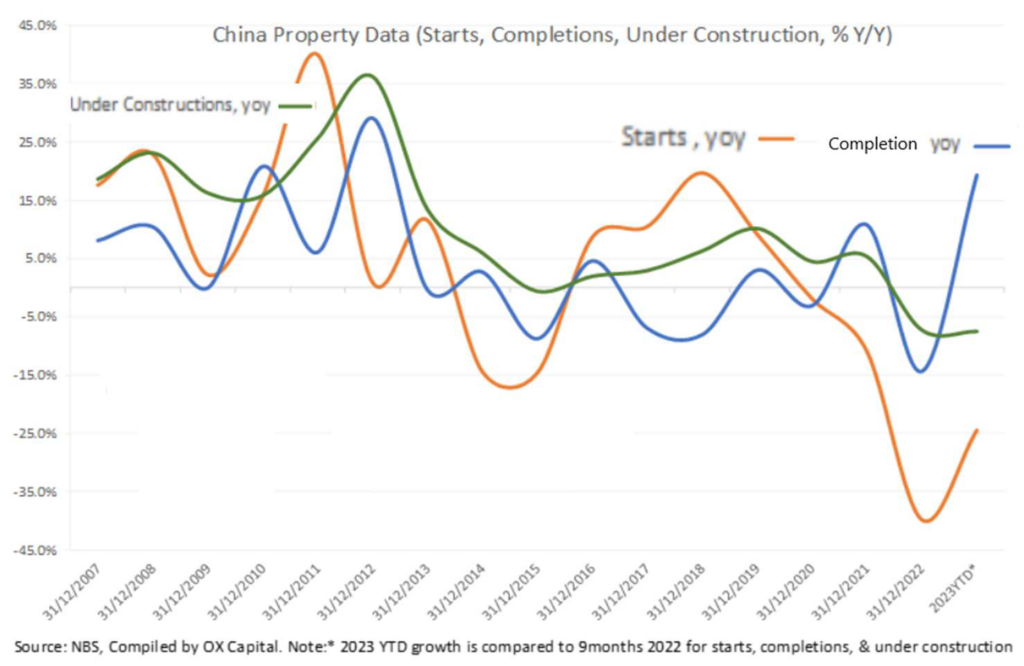

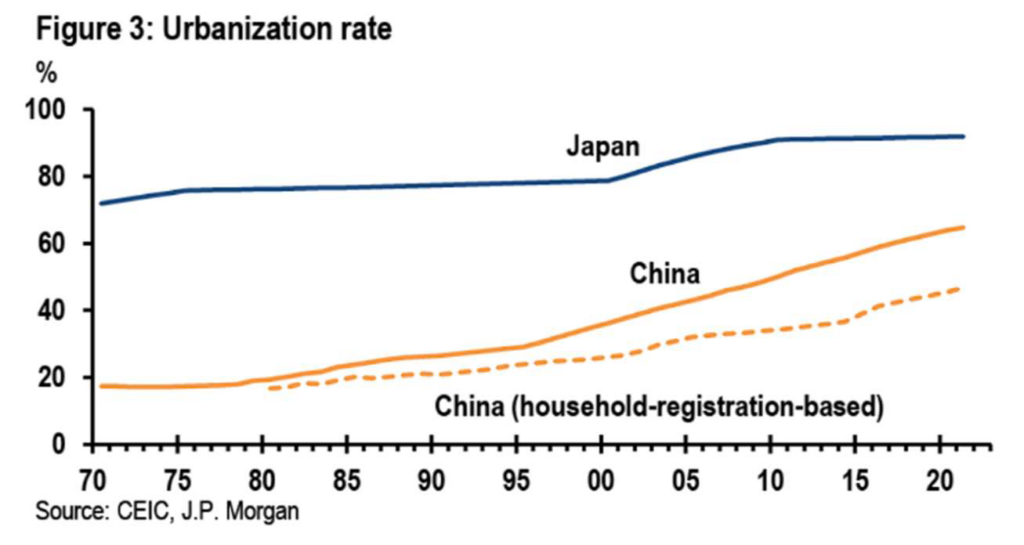

2) Housing starts have declined over 60% from peaks to 2023 YTD. Urbanization rate in China is only ~60%,

much lower than that of developed countries, and the lack of new starts in the system will ultimately reduce

overall supply (less completions) in the next few years. As such, supply and demand dynamics will increasingly

tighten.

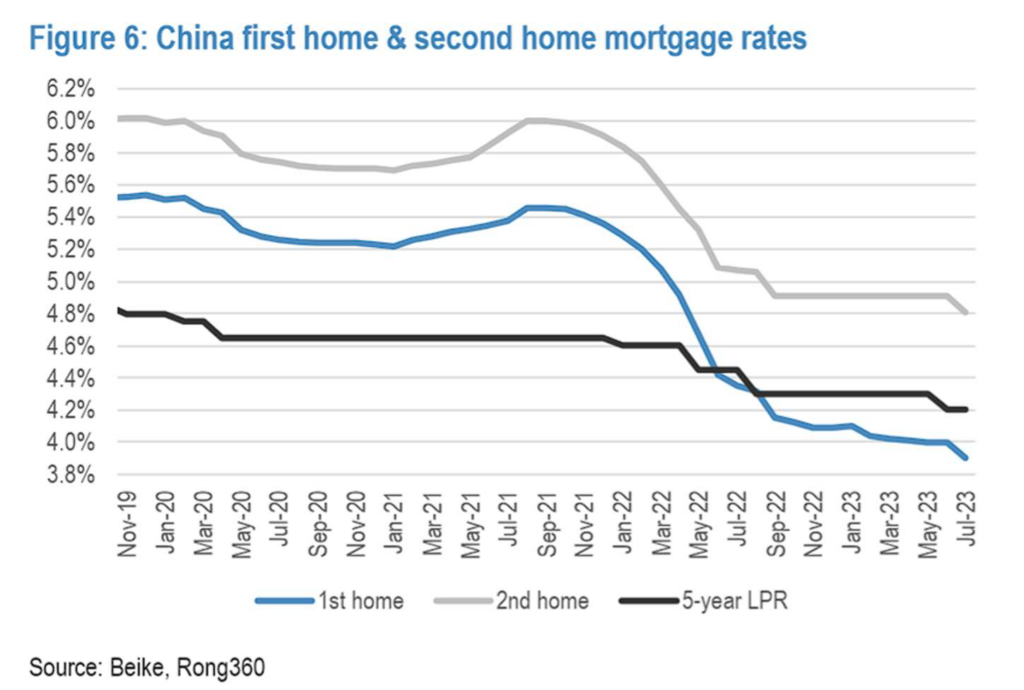

2. Affordable housing vs. other counties: China property prices are affordable relative to other EM/DM counties

while affordability will improve further as mortgages rates decline.

3. Stimulating growth: The Chinese authorities have started to stimulate the economy, showing an intention to boost growth, increase consumer sentiment and investor confidence. We believe further reforms are likely to mitigate risks to the broader economic recovery. Notably, our base case for China is that of continual policy easing and continued government stimulus, an environment ripe for improving economic activity.

Equity market correction provides entry point. Although we do not believe it is the time to buy China developer stocks given structural headwinds facing the sector (i.e. Lower household formation), and we believe the property sector is set to stabilize rather than a robust recovery.

However, we do believe this set-up of “stimulating growth” is a similar playbook to the GFC in USA and Europe in 2009 when it was a great time to own quality growth companies at deeply discounted valuations. As such, we view a similar set up for many quality growth stocks in China at inexpensive valuations now.

OX Capital Stock Highlight:

Anta Sports, (ticker HK 2020), sits at 3.8% weighting in the OX Dynamic EM Fund, vs. the Benchmark of 0.22%, as at Sept 30, 2023. Anta is a leading quality multi-brand sportswear company in China. Noticeably, it has overtaken competitors Nike and Adidas as the top sportswear brand in China. Leveraging the playbook of the luxury goods maker like LVMH, Anta is building a platform of multiple high-end brands. FILA alone will be a Rmb50 business in the next 2-3 years. Descente in skiwear where a ski jacket can cost over $1000. Lululemon is in its crosshair as well. Longer term, it will further develop other premium brands and sports such as Arcteryx, Salomon, Wilson, and Descente Golf in China. The company is positioned to deliver double digit per annum growth as it gains and sustains market share, driving brand synergies through its portfolio. Despite this backdrop and outlook, the shares at 23x P/E vs Nike (Ticker: NKE US) which trades at 30x P/E.

At Ox, we are focussed on the quality leaders outside of the property development sector with long term growth.

Current valuation is providing lots of interesting opportunities.