A Bustling Southeast Asia: Ox on the Ground

Robust economic outcomes are being driven by strong domestic demand and a continued stream of FDI into key portfolio countries in SEA.

We visited the Southeast Asian (SEA) region and left with increased confidence on its outlook. Economies like Indonesia, Malaysia and Vietnam are booming with expected GDP growth rates as high as 7% in 2024, despite the fact that these nations have kept their interest rates high thus far to stabilise their currencies in the face of a stronger USD. Imminent US Fed rate cuts will enable key countries we are investing in SEA to drop their own policy rates. This is supportive of the performance of equity markets, which are cheap relative to history.

During our time in Indonesia, we found the equity market to be outside the spotlight of many foreign investors. They have strong endogenous growth drivers, supporting economic outlook over the coming years. Investment and consumption in Indonesia are growing, supported by a young and growing middle class, while foreign direct investment (FDI) continues to stream in from global and regional champion companies, which will provide more quality goods to increasingly wealthier Indonesians, as well as stronger exports.

We came away from our visit to Indonesia with further confidence in our holding BYD and their long-term outlook. Their ability to continue to grow their significance in Indonesia and in export markets outside China is supported by a strong commitment to establishing significant manufacturing capacity offshore. BYD expects their huge 108ha industrial plot in Indonesia to be online as soon as early 2026, to support both domestic and export demand, completely built in Indonesia!

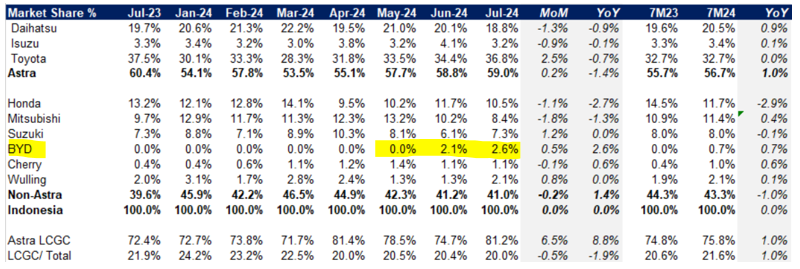

BYD began selling cars in Indonesia just two months ago in June 2024 and has achieved close to 3% market share in July already with limited models available. We are reminded each time we return to Indonesia that the 7-seater is the popular model in this market. BYD’s most recent launch of Indonesia’s first ever 7-seater electric vehicle, the BYD M6, will further spearhead their efforts in Indonesia!

In addition to the global companies which are driving FDI into Indonesia, locally grown Indonesian corporates we visited are also gearing up for the next stage of strong growth. Notably, portfolio company Pakuwon (a residential and retail property developer), who we visited in Jakarta, has a strong plan for expansion into the outer islands of Indonesia which provide opportunities to tap an increasingly wealthy Indonesian consumer who lives outside of Java.

Pakuwon is confident that the time to prepare for the next stage of growth is now and has increased their capex budgets for 2024 and 2025 compared to recent years. This will be supported by its strong net cash balance sheet and healthy cashflows and can see strong growth visibility over the next three to five years! We added to Pakuwon during market weakness at less than one times price-to-book and see strong earnings prospects for this holding.

Corporates we visited generally expressed a high level of business confidence and capex intention. Ox Capital met with the CFO of both Bank Mandiri and Bank Negara (two of our key holdings) during our trip and came away confident of continued strong and responsible loan growth and its low-cost of funding.

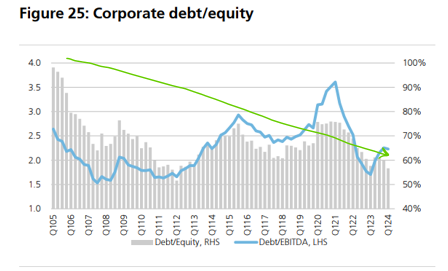

We are confident that strong demand for loans can continue due to low levels of corporate indebtedness in Indonesia, as well as low levels of bad debts in our portfolio banks. These banks are generating 15 to 20% plus returns on equity, trading at attractive valuations and are providing a large and sustainable 6-7% dividend yield, supporting a strong investment case in our view.

Corporates in Indonesia are at historically low levels of leverage and can benefit from lower rates and stronger growth going forward.

SEA has not been unaffected by the global buzz around AI. In fact, during our time in the region, we visited several industrial estates throughout Indonesia and Malaysia, who are seeing strong demand from global hyperscalers, amongst others for their AI data center sites.

Our research suggests that the capex intention of global hyperscalers such as like Google, Meta, Microsoft, amongst others, into AI investment, remains strong. The attitude amongst these companies largely remains that the risk of underinvestment in AI is higher than that of over-investment at this juncture, despite questions around the short-term return on such investments. This capex intention is supportive of continued FDI into such sites in Southeast Asian countries, such as Malaysia and Indonesia.

Johor, Malaysia which we visited on our trip, has emerged as the largest data center hub in Malaysia. Located just ~30km from Singapore CBD, we saw demand for industrial land being driven by data centers and light manufacturing of global companies, many of which have corporate headquarters in nearby Singapore.

Similarly in Indonesia, we visited one of their largest industrial and commercial estates, Kota Deltamas, located ~40km outside of Jakarta, where demand for industrial land is also being largely driven by data centre players, with significant investment planes over the next few years. Deltamas counts Singtel is amongst its clients, as well as multiple members of the “Magnificent Seven”, providing state of the art facilities for global companies in Indonesia.

In the left picture below our time with the Deltamas management team is captured, whilst on the right we see Singtel’s first of four planned state-of-the-art data centers at the site. Singtel will have an IT load of ~100MW here once complete!

Lastly, it would be remis of us not to mention our final stop in Singapore, where we met with strong regional companies operating throughout Southeast Asia. More and more we are witnessing the strong role Singapore is playing in positioning itself as the regional ASEAN hub, providing financial related services support for the region, particularly the many family offices and private banking clients who have flocked here over recent years.

Given the increasing sophistication of industries in Singapore, we also see more and more outsourcing of resource, power, and labor-intensive industries to neighboring, low-cost Asian economies. This benefits nations such as Malaysia and Indonesia, who Singapore are drawing on for resources to support their economic development!

Resilient economic development of these Southeast Asian nations is supportive of stronger equites markets in the region. These markets are currently trading at attractive valuations, and theUS Fed rate cuts will likely be very positive. The strong companies we own have high likelihood of earnings delivery, are available at attractive valuations and dividend yields!

At Ox Capital, we are focused on quality companies with long term growth which are available at inexpensive valuations across emerging markets. Current valuations are providing lots of interesting opportunities. Let us know if you would like to understand specifically where we are finding the opportunities!

Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting. This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Ox Cap nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.